If you were to judge Webull vs. Coinbase purely by user accounts, this comparison post would be pretty short.

Currently, Coinbase has about 98 million accounts.

Webull has roughly 7 million.

However, it’s not fair to compare Coinbase and Webull using this metric.

In fact, some might argue Webull and Coinbase don’t belong in the same category.

What do I mean?

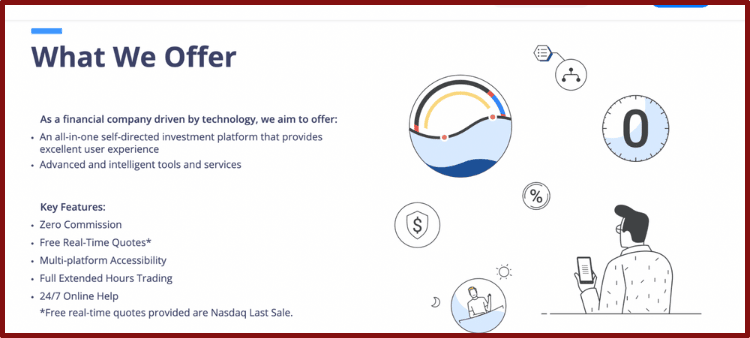

Well, Webull is more of an “all-in-everything” trading app, while Coinbase solely focuses on crypto.

Sure, both of these platforms offer ways to get into crypto trading, but Bitcoin has never been at the core of Webull’s mission.

Coinbase and Webull tend to attract different customers with unique investing goals.

Although the Coinbase and Webull logos are both blue, please don’t let that confuse you!

There are significant differences between these hot trading platforms.

You need to carefully consider the services offered on Webull vs. Coinbase before deciding which is better for your investing goals.

Webull vs. Coinbase — A Brief Review Of Two Big & Blue Trading Platforms

- Availability in USA

- Ease of Set-Up

- Security

- Ease of Use

- Access to Cryptocurrencies

- Customer Service

- Trading Fees

- Passive Income

Availability in USA

Despite its close ties to China, Webull is easily accessible in all 50 US states.

You could also access Webull’s app in many foreign countries like Japan, the UK, and Australia, to name a few.

Interestingly, it’s slightly easier for Americans to get a Webull account versus Coinbase!

Even though Coinbase operates in over 100 countries, it’s still unavailable in Hawaii.

Hey, I guess that’s the price of living in Polynesian paradise!

So, if we’re judging by availability in the USA, I’d have to give this category to Webull.

Although, from an international perspective, Coinbase is one of the most accessible crypto exchanges.

Plus, if you’re an American outside of Hawaii, there won’t be any issues setting up a Coinbase account.

Winner: Webull for Americans; Coinbase internationally.

Ease of Set-Up

It’s a breeze to sign in to Webull and Coinbase.

These companies make it easy for beginners to get established with a trading account in a few minutes.

Just keep in mind that Webull and Coinbase take compliance seriously.

This could be a pro or con, depending on your feelings about privacy.

You will have to submit more personal info to use Webull and Coinbase versus a decentralized exchange like Uniswap.

However, most centralized exchanges require KYC info to remain compliant with regulators.

Also, in exchange for handing over your KYC documents, you’ll enjoy the special insurance features Webull and Coinbase offer.

If you’re OK sending your social security number and a photo of your driver’s license to Webull and Coinbase, it won’t take long before you can access the trading portal.

Once you’re logged in to either platform, you could use ACH or wire transfers from your bank to fund your account.

Coinbase also offers credit, debit, and PayPal transfers for a higher fee.

To my knowledge, you still can’t use cards or apps like PayPal on Webull.

So, I guess Coinbase has a slight edge in this category because it has more payment options.

However, both of these apps make it easy to get into their ecosystems.

Winner: Coinbase

Security

Coinbase and Webull offer their customers top-of-the-line security features.

Both companies use fantastic firewall and encryption technologies to protect your data.

You should integrate your account with a 2FA app like Google Authenticator to significantly reduce the risk of a hack.

Coinbase and Webull also offer customers generous insurance policies.

While Coinbase can’t offer FDIC on cryptocurrency, it offers every customer $250,000 in FDIC protection for USD.

Coinbase is also one of the world’s top-rated crypto custodians, and it keeps 98 percent of its digital assets in cold storage wallets.

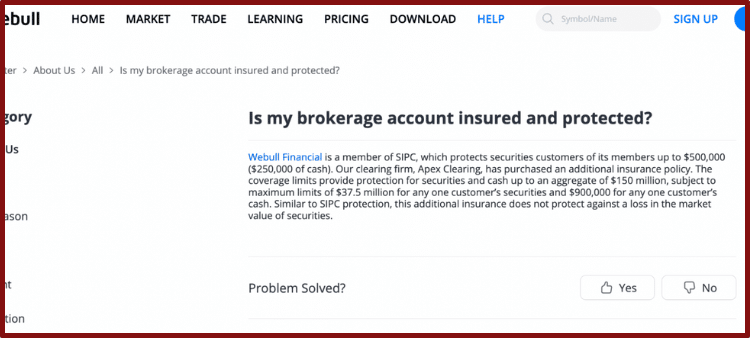

Since Webull offers stock trading, it carries SIPC protection of $500,000 plus $250,000 insurance for cash for every user.

Also, Webull has additional protections through its partner Apex Clearing House.

According to Webull, Apex Clearing has $150 million in insurance for its clients.

Plus, since Webull and Coinbase have offices in the USA, they are incredibly transparent about their finances.

However, I will give the slight edge in this category to Coinbase yet again.

Why?

One reason: Self-custody.

If you’re buying crypto on Webull, you can’t take it off of your app and put it in a private wallet.

At least not yet.

While I don’t think Webull would do anything malicious with your crypto, there’s always a chance this platform could get hacked or go bankrupt.

Crazier things have happened.

Personally, when I invest a significant amount of money into crypto, I want to be in complete control of my coins.

To do this, you must transfer crypto off an exchange into a private wallet (e.g., Trust Wallet or Metamask).

Currently, Coinbase makes it so easy to send crypto off of their market into whatever private wallet you most enjoy using.

Heck, Coinbase has a self-custody wallet called (surprise) the Coinbase Wallet!

If self-custody is a big deal to you, Coinbase is the obvious winner in this category.

However, that doesn’t mean Webull is “unsafe!”

These trading platforms are some of the most secure in the industry.

Winner: Coinbase

Ease of Use

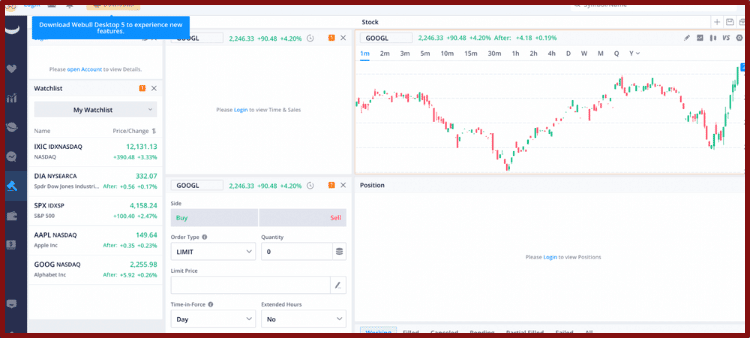

Even Webull fans admit that this platform doesn’t have the most intuitive UI/UX.

And, to be honest, I think Webull purposefully made their design extra complex.

Why?

Robinhood!

To this day, Robinhood is Webull’s most direct competitor.

Both of these trading apps have almost identical features, but Robinhood has a super simple UI.

While Webull’s interface isn’t “bad,” it takes a little getting used to.

This may turn off absolute beginners, but the benefit is that Webull offers more charting tools for technical analysis versus Robinhood.

OK, so what about Coinbase?

To explain Coinbase’s UI, we have to distinguish Coinbase Standard from Coinbase Pro.

The traditional Coinbase platform is incredibly intuitive to use for quick market orders.

However, the Coinbase Pro platform has a more advanced set-up for traders who enjoy candlestick patterns and limit orders.

If you’d like more in-depth details on Coinbase’s UI, I’d recommend reading my previous review of “Coinbase vs. Gemini.”

Since Coinbase gives customers the option of both a simple “Robinhood-like” standard design and a Pro platform, I will give this category to Brian Armstrong.

While Webull’s UI isn’t as complex as Binance or KuCoin, it’s also not as clean as Standard Coinbase, Gemini, or Kraken.

FYI: If you’d like to learn what the heck Gemini and Kraken are, be sure to read this previous post.

Winner: Coinbase

Access to Cryptocurrencies

No matter what crypto exchange you’re talking about, the number of total tokens is constantly increasing.

Like it or not, altcoins keep increasing every single day.

As more people clamor for smaller tokens, most exchanges slowly comply with new coin listings.

However, since Webull isn’t a crypto-centric platform, it doesn’t offer as many altcoins as Coinbase.

Currently, there are around 40 tokens available for trading on Webull.

By contrast, Coinbase has about 100 crypto assets.

Even though Coinbase doesn’t have as many altcoins as Binance or KuCoin, that’s still impressive for an American exchange.

If you’re a serious speculator in the altcoin market, Coinbase will have more tokens to choose from.

However, those who are only interested in big-cap coins like Bitcoin, Ethereum, and Dogecoin probably won’t be complaining about a Webull account.

Winner: Coinbase

Customer Service

Coinbase and Webull have a similarly lackluster customer service experience.

Just look at the current Trustpilot reviews if you don’t believe me.

Although Webull and Coinbase have Customer Care tabs, they have a terrible reputation with retail investors.

You can reach Coinbase and Webull via telephone or email, but you have to manage your expectations.

Generally, these companies will get back to you…but it may take a few business days.

The only difference I can see between Coinbase and Webull’s customer service is that Coinbase offers a unique perk to Coinbase Debit Card holders.

If you opt to get one of these fancy Visa cards, you should enjoy priority phone access.

To be honest, I haven’t used this feature myself yet, so I’ll have to report back if it works.

Hopefully, as these companies grow, they will invest more money into their customer service standards.

As of today, I’m just going to call this category a draw.

Winner: Draw

Trading Fees

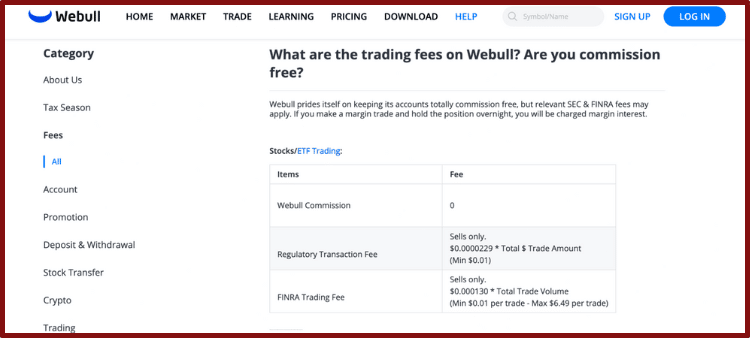

No contest; Webull wins in the trading fee department.

You’ll save way more money using Webull to trade digital assets versus Coinbase.

Like Robinhood, Webull is famous for its zero-commission fee structure.

You read that right: No commission fees!

While you will have to pay a spread on your trades, you won’t incur all of the extra “convenience fees” on Coinbase Standard.

By contrast, you’ll spend about 1.49 percent on all transactions on Coinbase over $205. Under this amount, Coinbase charges different bonus fees depending on how much you spend.

Coinbase also charges extremely high rates to transfer money from a card or PayPal account.

Even though Coinbase Pro has better rates, how could you beat free commission trading?

Coinbase Pro users have to pay a flat fee of 0.6 percent for takers or 0.4 percent for makers for trades under $10,000.

Keep in mind that Webull doesn’t give its users the option to transfer crypto out of its exchange.

If you’re interested in using crypto in DeFi or storing it in a cold wallet, you can’t do so on Webull.

So, even though you’ll enjoy lower fees, you can’t use your crypto in Web3.

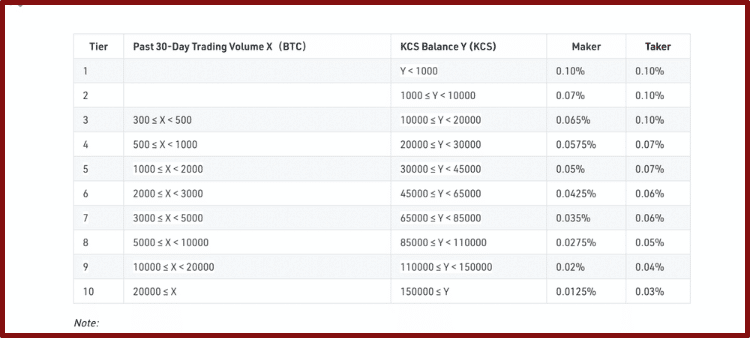

Also, other crypto exchanges offer more attractive fees than Coinbase.

For instance, FTX, Binance, and KuCoin have some of the lowest fees in the industry.

If you’re interested in keeping your crypto while paying minimal fees, you should investigate these options before diving into Webull.

That being said, Webull is a fantastic option for people who hate paying trading fees.

Winner: Webull

Passive Income

One way Webull can offer such attractive fee rates is by slashing passive income opportunities.

Even if you leave cash sitting in your Webull account, they won’t reward you with a measly < 1 percent interest rate.

While you can generate passive income with dividend stocks on Webull, there aren’t passive income portals per se.

This is especially the case with Webull’s crypto offerings.

Unlike Coinbase, you can’t stake digital assets to earn yield.

You also can’t transfer your tokens off of Webull into interest-bearing accounts, liquidity pools, or lending & borrowing platforms like BlockFi.

Currently, Coinbase has more ways you could generate passive income while “hodling” coins.

As already mentioned, Coinbase allows customers to stake tokens like Ethereum, Algorand, and Cosmos to earn rewards.

There’s also a “Learn to Earn” feature on Coinbase that awards you with altcoins after watching a few videos.

As previously mentioned, Coinbase has a highly-rated non-custodial wallet that you could use to interact with DeFi or stake tokens in-app.

Oh yeah, and don’t forget about Coinbase’s crypto rewards debit card!

Since Webull is constrained by its zero-commission fee offering, I doubt it will ever offer more passive income opportunities than platforms like Coinbase.

Coinbase isn’t the greatest platform for passive crypto income, but it’s way better than Webull.

Winner: Coinbase

So, Spencer, Why Would Anyone Want A Webull Account?

Before you start complaining that I was too harsh on Webull, hear me out!

Webull isn’t a crypto-first platform, and this blog is focused on crypto investing.

Most people involved in crypto want full custody over their tokens, and Webull doesn’t provide that.

If Webull introduces a way to move your tokens off of its platform, then it may have a shot of taking on big boys like Coinbase.

As it stands today, I’d only recommend Webull to crypto dabblers.

However, I get that Webull isn’t primarily for crypto investors.

Webull is more in the category of “all-in-one” trading apps like eToro, Uphold, or Robinhood.

These platforms offer customers access to a smidge of crypto plus traditional ETFs, options, and stocks.

So, if you’re interested in TradFi investing and want to dip your toes into crypto, Webull may be all you need.

This app offers a lot to admire, like low fees, high security, and superb insurance.

However, if you’re only interested in digital assets, you should stick with a crypto-focused exchange like Coinbase.

If you don’t get why I’m so crazy about self-custody, please check out my previous post on “Exchange vs. Crypto Wallets.”