I’ve got to level with you: KuCoin isn’t my preferred crypto exchange.

If you’ve read through my post on “Binance vs. KuCoin,” then you’ll know why.

Terrible customer service!

However, I recognize that KuCoin has many redeeming features, especially for advanced crypto traders.

Also, I’m aware KuCoin offers outstanding trading fees, especially if you use their KCS token.

Short for “KuCoin Shares,” KCS has many attractive features if you frequently trade with a KuCoin account.

So, if you’re thinking about joining the “KuCoin crew,” this may be the article for you!

Below, I will review what KCS is and how to buy it.

Hold On, Spencer! What Is KuCoin And The KCS Token?

If “KuCoin” is a foreign term for you, let me bring you up to speed.

Created in 2017, KuCoin is one of the most prominent centralized crypto exchanges.

While this company isn’t as transparent as Coinbase or Gemini, we know it’s headquartered in Singapore and Seychelles.

New customers should know that KuCoin isn’t a good choice for beginners.

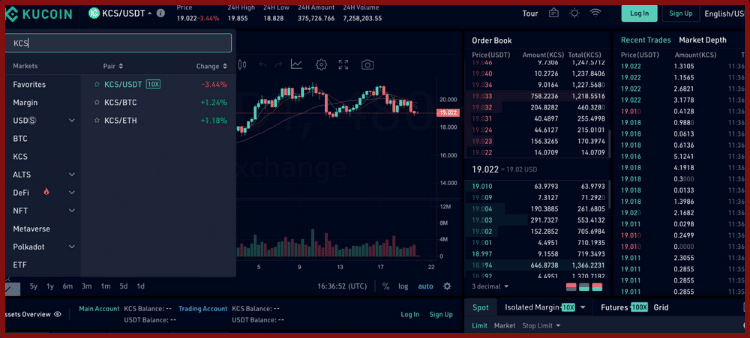

This exchange has a non-user-friendly layout with candlestick patterns and dozens of flashing price indicators.

You should have some crypto trading experience before opening a KuCoin account.

It’s also worth mentioning KuCoin doesn’t collect as much KYC as other exchanges.

In fact, KuCoin may be the only major centralized exchange that doesn’t abide by KYC requirements.

For privacy hawks, this is a huge plus.

However, this puts KuCoin in an awkward position from a compliance standpoint.

As much as crypto fans hate government regulation, it’s a fact of life.

Just look at what happened to Binance recently.

As Binance became the largest crypto exchange, it got more restrictive with its KYC policies.

Will the same happen with KuCoin?

I don’t know!

I just feel it’s important for new traders to keep these risks in mind when choosing KuCoin.

OK, so that’s basically what KuCoin is. Now, what the heck is KCS?

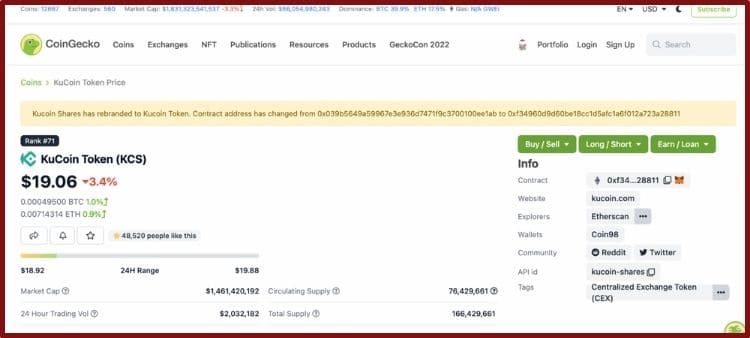

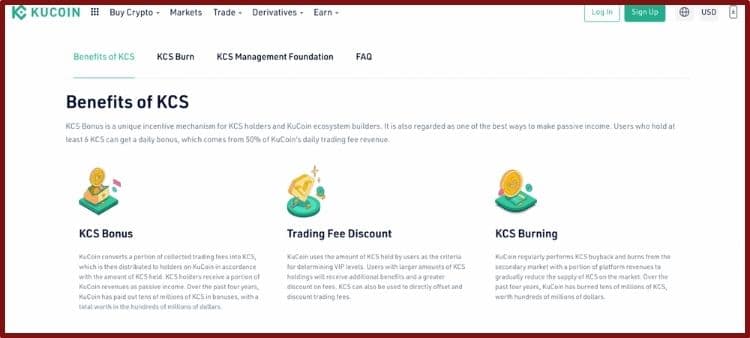

Put simply, KCS is KuCoin’s exchange token.

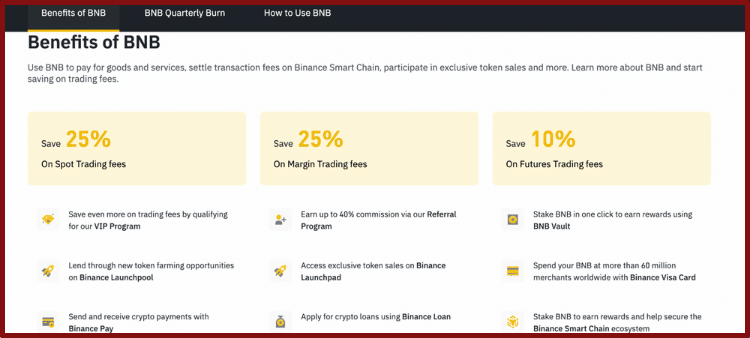

Like Crypto.com’s CRO or Binance’s BNB, KCS gives KuCoin users benefits within the exchange’s ecosystem.

The KuCoin team initially created 200 million KCS tokens using the ERC-20 standard. KuCoin also claims to buy some of its KCS tokens every quarter and burn them.

If all goes according to plan, KuCoin will keep buying and burning KCS until it reaches a 100 million total supply.

Why Would I Want To Buy KuCoin’s KCS?

OK, now you’re probably asking, “What’s the point of buying KCS tokens?”

One word: Perks!

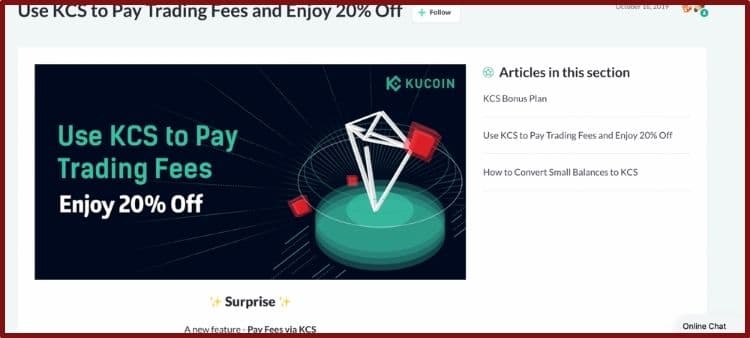

Sure, you could buy KCS as an investment, but most people use these tokens to shave off trading fees on KuCoin.

Currently, if you use KCS tokens to trade on KuCoin, you’ll get a 20 percent discount on your fees.

Considering KuCoin’s trading fees are already low at 0.1 percent, that’s a pretty attractive rate.

However, if you don’t mind holding your KCS over the long term, you could earn passive income on KuCoin.

KuCoin rewards all KCS holders with a 50 percent cut of all trading fees.

You should see these dividends appear in your KCS account each day.

Just remember these rewards are proportional to how many KCS tokens you’re holding.

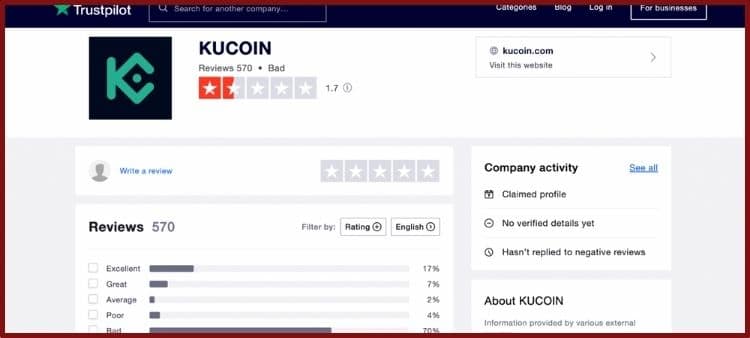

The third incentive to hold KCS tokens is to get a “fast pass” for KuCoin’s customer service.

As I hinted in the intro, it can take months to reach out to KuCoin if you’re just an average Joe.

And don’t take my word for it!

Check out all the negative comments on TrustPilot.

Honestly, I’ve never tried reaching KuCoin’s customer service while holding KCS, but I assume it’s a far better experience.

If you’re going to use KuCoin as your primary crypto exchange, this feature alone may be worth the investment.

What’s The Easiest Way To Buy KuCoin Shares?

The best way to buy KuCoin Shares is on KuCoin.

(Bet you didn’t see that one coming!)

While this may sound straightforward, it can be challenging for new crypto traders.

As I mentioned above, KuCoin has a more advanced layout.

However, by following the guide below, you shouldn’t have too much difficulty adding KCS to your KuCoin wallet.

Step One: Sign Up For KuCoin

If you don’t already have a KuCoin account, you’ll need to create one.

Unlike other exchanges, you don’t need to provide a ton of KYC info to use KuCoin’s exchange.

However, you will have to type in your email, phone number, and create a password. Also, you must enable 2FA with an app like Google Authenticator.

You can find the “Sign Up” button on the top right-hand corner of KuCoin’s home page.

Honestly, KuCoin has one of the most straightforward sign-up features for any crypto exchange.

As long as you provide the correct info and enter the security codes, you should have a KuCoin account in a few minutes.

Step Two: Fund Your New KuCoin Account

There are many ways you could add funds to your new KuCoin account.

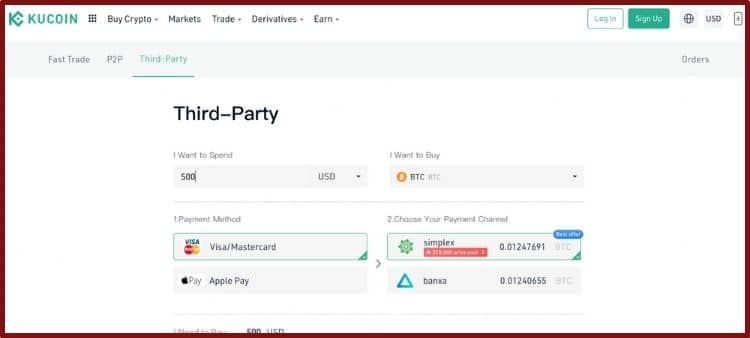

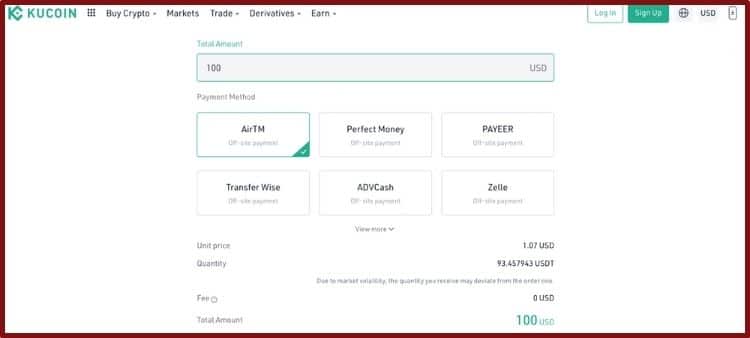

If you don’t already have crypto, you could buy many large-cap coins using KuCoin’s “Fast Trade” or “Third-Party Buy” features.

You can find these options on the top left-hand side of your KuCoin screen.

Just a few payment services KuCoin uses include Visa, MasterCard, Apple Pay, and PayPal.

However, these fiat onramps often charge high transaction fees, so be careful!

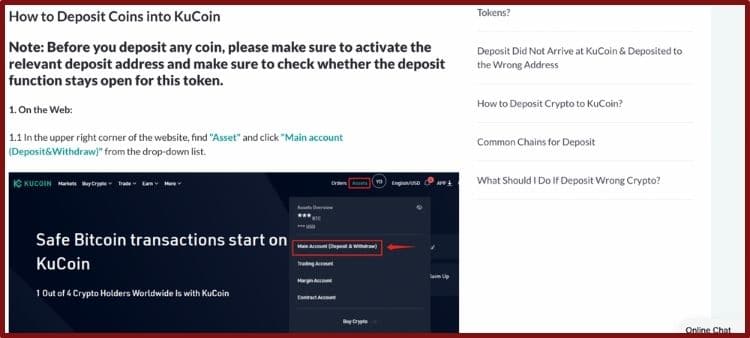

If you want to avoid these trading fees, you should consider sending some crypto from another wallet into your KuCoin account.

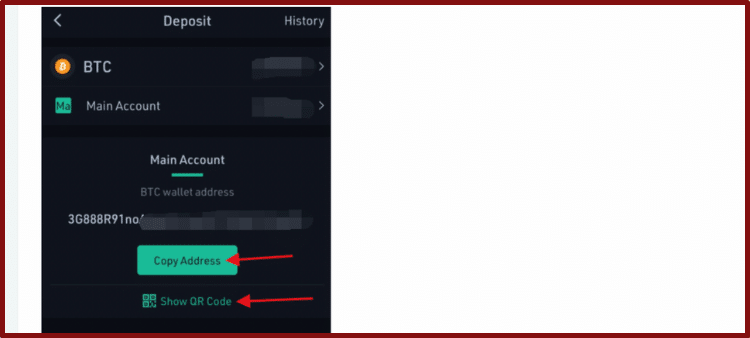

To do this, find the token you want to send on KuCoin and copy the recipient’s address.

For instance, if you want to send Bitcoin into KuCoin, click on your KuCoin Bitcoin wallet to find your public keys.

Once you’ve copied your Bitcoin address on KuCoin, open the crypto wallet you have Bitcoin stored on.

After you’ve selected Bitcoin on your private wallet, type in how much you want to send and paste your KuCoin Bitcoin address.

It shouldn’t take long to see Bitcoin appear in your KuCoin account.

Note: Only send cryptocurrencies into KuCoin that have a trading pair with KCS.

To avoid significant price fluctuations, I’d recommend using the stablecoin USDT.

However, you could also convert big-cap cryptos like Bitcoin or Ethereum into KCS.

Step Three: Buy KCS On KuCoin

Now that you’ve got crypto in your account, it’s time to get some KuCoin Shares.

Find the crypto trading pairs at the top of your Spot Trading screen and search for KCS. You should see a few options for converting your current crypto into KCS.

Again, I’d strongly recommend using the USDT/KCS pair. Since USDT is a stablecoin, it won’t fluctuate like Bitcoin or Ethereum.

However, please use the other trading pairs if you’ve only got BTC or ETH in your account.

Once you see the KCS chart on your page, you execute an immediate “market” trade or set a price you like with a limit order.

Limit orders will only execute if KCS hits the price you’ve established.

Just be sure to review the trading fees before confirming your transaction.

Is KuCoin’s KCS The Best Crypto Exchange Token?

Whether KCS is “worth it” depends on how you feel about KuCoin’s platform.

If you interact with KuCoin almost every day, KCS has a lot of utility.

However, there’s honestly no use-case for KCS outside of KuCoin’s ecosystem.

The same could be said for other exchange tokens like Binance’s BNB, Crypto.com’s CRO, and FTX’s FTX Token.

Each of these tokens offers phenomenal benefits if you already use the respective trading platform.

Just remember that KCS is an altcoin, which means it’s an inherently volatile asset.

So, KCS could be the “best” option for you, but that doesn’t make it the “greatest” exchange token.

Please take your time reviewing each of these crypto exchanges and their respective tokens.

Is It Safe To Use KuCoin’s Exchange?

When you hear a crypto exchange is based in an obscure place like Seychelles, you probably don’t feel all that confident about its security.

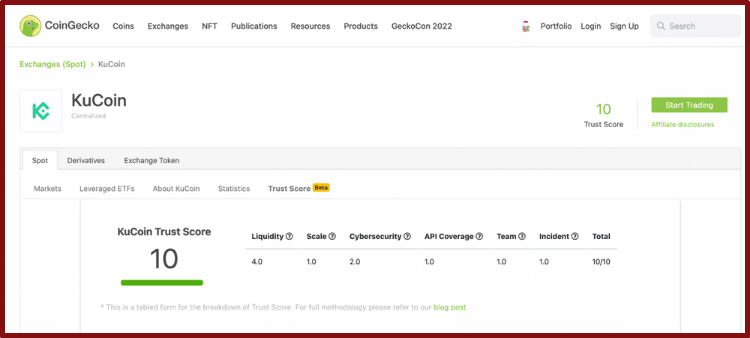

However, KuCoin is undeniably one of the more reputable centralized crypto exchanges.

CoinGecko and CoinMarketCap give KuCoin some of the highest trust rankings in the industry.

KuCoin also has a strong record for doing right by its customers.

Most notably, KuCoin quickly recovered funds for users who lost money in a 2020 hack.

Yes, hackers broke into KuCoin and made off with roughly $280 million.

Since then, KuCoin has restored all of that stolen money with funds from its insurance policy and partner exchanges.

Also, since KuCoin’s 2020 hack, it has beefed up its security standards.

For instance, KuCoin account holders must install 2FA to make withdrawals.

Of course, there’s always a risk to using a centralized crypto exchange.

Even big names like Coinbase, Crypto.com, and Binance got hacked recently.

So, while it’s generally safe to trade on KuCoin, you should transfer your crypto to a private wallet to avoid a catastrophic security breach.

Ideally, you should consider moving your crypto to a hardware wallet like Ledger or Trezor.

Either of these devices will keep your private keys offline, which makes your crypto un-hackable.

If you don’t want to buy a hardware wallet, download a high-quality hot wallet like Trust Wallet or Exodus.

For more details on using the Trust Wallet app, be sure to check out this previous post.

So, Is KCS A Good Deal For Crypto Investors?

KCS is an awesome altcoin if you’re a KuCoin fan.

However, if you don’t already have a KuCoin account, there’s not a whole lot you could do with KCS.

In fact, all you could do by holding KCS is to hope for it to go up.

While KCS may rise as crypto adoption increases, betting on altcoins is always risky.

Instead of “investing” in KCS, I think it’s better to use this token on KuCoin’s platform.

With KCS, you could enjoy trading discounts, generate passive income, and get first access to customer service.

All of these features are pretty sweet if you’re on KuCoin.

However, if you’re not keen on KuCoin, you probably won’t get a ton of value holding on to KCS.

Want to learn how I make money using crypto? Check out my favorite node project here.