“Self-custody” is a core concept in cryptocurrency.

Instead of entrusting a bank to guard your stash of cash, only you control your digital tokens.

Well, to be more accurate, you control your crypto after you take it off of an exchange.

While there’s nothing “wrong” with leaving tokens on a legit exchange, it kind of goes against the ethos of cryptocurrency.

You know the saying, “Not your keys, not your crypto.”

However, there are select cases where you may not mind leaving some crypto in a regulated third-party account.

I know; crypto purists will always tell you to store crypto in a private wallet—but hear me out!

There are risks and benefits to using either of these storage options.

Crypto investors need to know the concerns and opportunities associated with private vs. exchange wallets.

With a firm understanding of these custody choices, you should know where to store your digital assets.

What’s The Big Difference Between A “Crypto Wallet” And An “Exchange Wallet?”

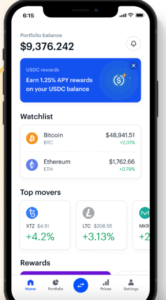

When you sign up for a centralized crypto exchange, you should get access to a complimentary custodial hot wallet.

The key word here is “custodial.”

And the “key” feature of custodial wallets is that you don’t have your private keys!

Those all-important private keys give you full access to digital tokens.

So, if you keep your Bitcoin on an exchange like Coinbase, then Coinbase is holding those coins on your behalf.

Your satoshis only become “yours” when you transfer them off of Coinbase into a non-custodial wallet.

As you might’ve guessed, non-custodial wallets provide you with private keys. You could also use the public keys associated with various tokens to receive crypto from an exchange.

OK, now that you know more about crypto custody, it’s time to discuss different storage options.

Hot vs. Cold Storage Wallets — What’s The Better Choice?

In the world of crypto wallets, “some like it hot,” but others love the cold.

What the heck am I talking about?

Hot vs. cold storage, of course!

You see, there are two types of wallets in cryptocurrency.

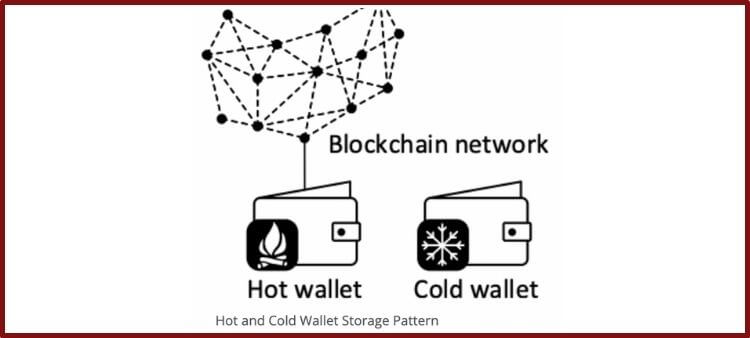

Hot wallets are connected to the Internet, while cold wallets store private keys offline.

Nowadays, most cold wallets use hardware devices like a Trezor or Ledger.

Since cold wallets keep your precious keys offline, they are the most secure option.

Unless someone knows your “seed phrase” or your device’s PIN, they can’t steal the crypto on your cold wallet.

By contrast, hot wallet apps can get hacked.

While it’s unlikely high-quality hot wallets will face a hack, it’s always a possibility.

On the positive side, many great hot wallets are free to download and easy to integrate with DeFi.

Hardware wallets offer greater security, but they have a higher upfront cost.

Also, it can be cumbersome to plug in your device every time you want to make a transaction.

Typically, crypto enthusiasts recommend storing any tokens you’re planning to “hodl” for years on cold storage.

If you’re more interested in short-term trading or interacting with DeFi, then a hot wallet will probably be the better option.

So, What’s So Bad About Leaving Crypto On An Exchange?

Most people involved in cryptocurrency will tell you to immediately transfer your tokens off an exchange into a private wallet.

Why?

Well, it all comes back to “self-custody.”

As long as that crypto remains on a centralized exchange, you can’t control it.

Also, since exchanges have a lot of cryptos, they are juicer targets for hackers.

Even trustworthy exchanges like Coinbase, Binance, and Crypto.com have faced significant hacks in recent years.

Lastly, there’s no telling when a crypto exchange could go bankrupt or suddenly freeze your account.

Since the crypto on an exchange is basically an “IOU,” you may not get those tokens if your company goes belly-up.

The only way you own your crypto is by putting it in a private wallet.

That being said, there are situations where leaving crypto on an exchange may not be “so bad.”

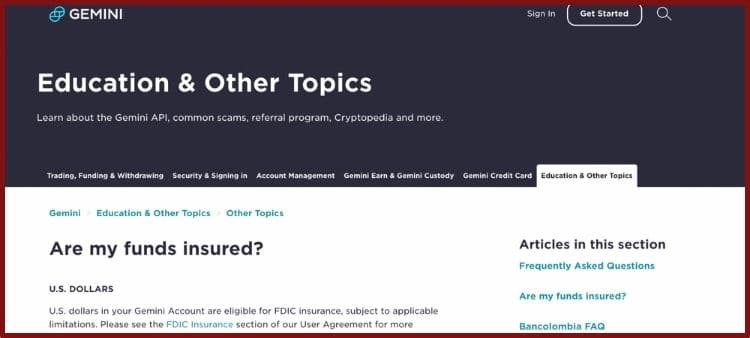

Indeed, many centralized exchanges have excellent security standards and insurance policies.

For instance, Gemini and Coinbase cover any USD you deposit on their platform with FDIC.

Also, all legit exchanges keep the bulk of their crypto on cold storage.

So, even though you don’t “own” crypto on your exchange, it’s pretty dang safe—provided you’re using a legit company.

By now, you may be thinking: “Spencer, why would I take the risk of leaving crypto on an exchange?”

Two words: Passive income.

You see, many exchanges have generous staking platforms where you could earn more crypto while “hodling.”

For instance, Crypto.com and Gemini have “Earn” features where you could lend your crypto to the exchange and earn regular rewards.

Yes, there are significant risks to these programs; I’m not denying that!

However, some investors may feel comfortable allocating some crypto into these programs.

Of course, if you’re most concerned with safety and self-custody, then you should take your crypto off the exchange.

I’d recommend long-term investors store most of their crypto in a cold storage device.

However, it’s at least worth considering passive income services on highly-rated crypto exchanges.

By the way, if you want more info on generating interest via exchanges, be sure to check out this review on “Coinbase vs. Gemini.”

So, What’s The Safest Crypto Wallet?

As I mentioned above, cold storage wallets are always safer than hot wallets.

However, everyone has a different opinion on the “safest” hardware wallet.

All I’ll say is the following brands are well-regarded in the crypto industry:

As for hot wallets, there are plenty of high-quality options to choose from.

Picking your ideal hot wallet will depend on a few personal factors like what exchange you use and whether you prefer desktop or mobile apps.

To help make your decision process simpler, I’ll give a mini-review of a few top-rated hot wallets.

Honestly, all of the hot wallets below are great options, so please take your time researching all of them.

Also, please remember that all of these wallets are free to download, so you can hold multiple accounts for different purposes.

- Exodus: A stylish and easy-to-use wallet that’s available on both desktop and mobile app.

- MetaMask: The premier browser extension wallet for DeFi, especially on Ethereum.

- Trust Wallet: One of the highest-rated mobile wallets that’s perfect for fans of Binance and the Binance Smart Chain.

- Coinbase Wallet: The ideal non-custodial wallet for anyone that already has a Coinbase account.

- Crypto.com DeFi Wallet: The best choice for fans of the Cronos Chain and the growing Crypto.com ecosystem.

By the way, you could find out more about my opinions on Trust Wallet and MetaMask in this previous post.

You can also check out these best crypto wallets for beginners:

How Do I Send Crypto From An Exchange Wallet To A Private Wallet?

By now, you should know how much crypto you’d like to send off of an exchange.

So, how do you do that?

Don’t worry; it’s not too difficult.

Plus, once you successfully transfer your first crypto, you’ll know how to do it on any exchange.

First, open the wallet you want to send your crypto to.

For this example, let’s assume you want to send some Ethereum to your Trust Wallet.

So, after you open your Trust Wallet app, click on “Ethereum.”

Here, you should see a button to “Receive” this token. After clicking this button, you’ll see a public address and a QR code.

Copy this public address to your clipboard, or have the QR code ready for later.

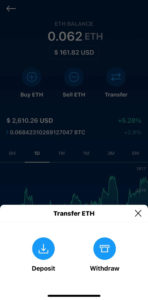

Next, log into the crypto exchange where you have your Ethereum.

Let’s say you want to transfer some Ethereum on Crypto.com to Trust Wallet.

Once you open your Crypto.com account, scroll to Ethereum and hit “Withdraw.”

You’ll have to enter how much ETH you want to send and paste your Trust Wallet’s ETH address.

After you review any associated fees, you can confirm the transaction.

Within a few moments, you should see the Ether pop into your Trust Wallet account.

The only difference with transferring crypto to a cold storage wallet is that you need to plug your device into a computer beforehand.

If you’re still confused about sending crypto to and from wallets, be sure to read my recent tutorial on “Withdrawing from Trust Wallet.”

How Do I Backup My Crypto Wallet?

Non-custodial wallets give investors complete control over their crypto.

On the downside, there’s no “customer service line” you could call if you lose access to your wallet.

So, what happens if your phone goes down or you break your computer?

Is that it for your crypto?

Don’t panic!

You can still recover your crypto if you have your “seed phrase.”

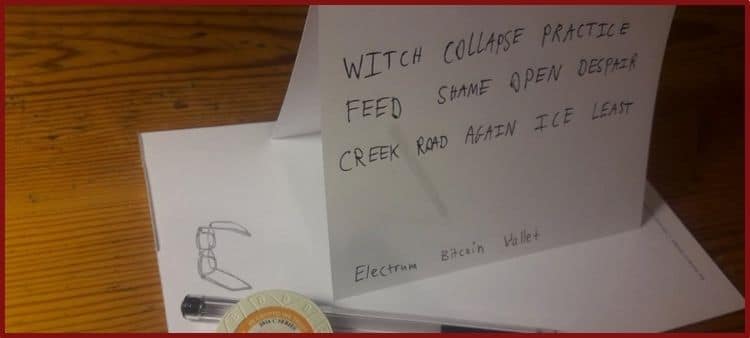

Whenever you set up a hot or cold wallet, you’ll have to write down a series of words that represent your private key.

Since your crypto is always on the blockchain, you can recover lost funds with this address.

Therefore, you need to keep these words in a super-secure place.

Preferably, you should write this “seed phrase” on a few pieces of paper and put them in a fireproof safe.

There are even a few manufacturers that offer stainless steel “seed phrase wallets!”

Does that seem paranoid?

Well, remember that only you are in control of your crypto.

If you mess up, you could lose a lot of money.

Unfortunately, that has already happened to many early Bitcoin investors.

When you take custody of your crypto, you should be paranoid about this seed phrase.

Please Know The Risks And Benefits Of Crypto Self-Custody!

A great advantage of crypto is that you can control your digital assets.

On the downside, the responsibility for securing your coins is on you.

If you fail to secure your seed phrase, nobody’s going to help you out of a jam.

While it’s always “safer” to take your crypto off of an exchange, please remember there are risks associated with self-custody.

Please be sure you keep that seed phrase in a secure spot, and always use security features like 2FA or biometric login when available.

These tools will ensure your crypto is secure for years to come.

Want to learn how I make money using crypto? Check out my favorite node project here.