Stablecoins have been in the headlines recently…and not for good reasons.

Honestly, it’s never good news when stablecoins take center stage!

If you’ve been living in a crypto-free cave recently, you should know by now that Terra’s hot new stablecoin UST just got rekt.

Within four days, about $60 billion got wiped out of this high-flying crypto project.

So, yeah, there’s a lot of drama right now concerning stablecoin regulation.

Since UST is no longer an option, many people have moved back into the “tried-and-true” centralized stablecoins.

Unquestionably, the two most notable projects in this category are USDT and USDC.

While there are a ton of stablecoins to choose from, these two coins hold the lion’s share of this market.

However, even though these stablecoins have the same 1:1 peg with the US dollar, they have many features that set them apart.

If you’re interested in using stablecoins for trading, lending, or borrowing, you need to consider which one you invest in.

As the Terra disaster recently shows, stablecoins aren’t always stable.

Just because USDT and USDC are so large doesn’t mean they don’t have risks you need to be aware of.

Let’s Start With The Basics — A Brief Overview of USDT vs. USDC

Before I compare USDT vs. USDC, I think it’s best to give you a bit of background on these projects.

Let’s first take a peek at the history of these stablecoins to understand their reputation in the crypto industry.

What The Heck Is USDT?

There’s a lot of mystery and complexity surrounding the USDT stablecoin.

Indeed, USDT is the unintentional “drama queen” of cryptocurrency.

Ironically, programmers designed USDT in 2014 to remove drama from crypto trading.

Sometimes called “Tether,” USDT is a digital token with a 1:1 value with the USD.

As the world’s first stablecoin, Tether has enjoyed a huge first-mover advantage, and it’s considered the most actively traded crypto of all time.

USDT is widely available on many blockchains, but it’s most popular on Ethereum.

As a centralized stablecoin, USDT is owned and operated by a company called Tether Limited.

However, it’s widely known that the Hong Kong exchange Bitfinex pulls the strings on Tether’s operations.

Tether Limited has maintained it has enough reserves in various assets to back every USDT it issues.

However, many regulatory bodies have taken issue with Tether’s lax auditing standards.

Although Tether Limited published a few graphs supposedly detailing its reserves, skeptics still aren’t buying it.

In fact, the NY’s Attorney General’s Office sued Tether Limited recently for its questionable financial practices.

Although Tether Limited never said it was guilty of any “shenanigans,” it paid New York about $18.5 million.

Despite all of this controversy, USDT is usually in the top three cryptocurrencies by market cap.

Currently, USDT has a market cap of about $70 billion.

OK, So What Makes USDC Different?

At face value, USDT and USDC are the same.

Both of these coins are 1:1 pairs with the US dollar.

However, USDC has way less drama surrounding it — especially for American investors.

Why?

For starters, USDC is an American invention.

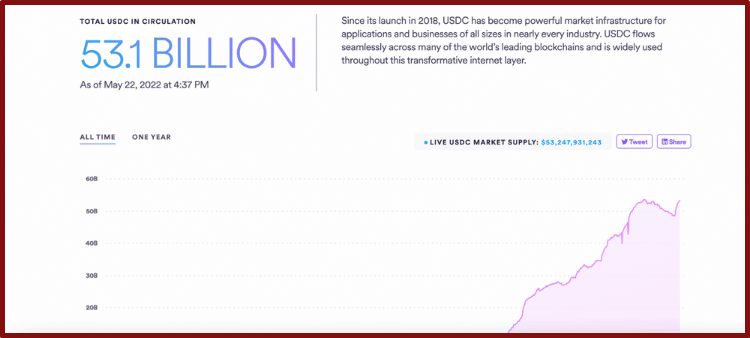

The US-based companies Circle and Coinbase created USDC in 2018.

If you’ve read through my review of “Gemini vs. Coinbase,” you’ll know that Coinbase is one of the most compliant exchanges in the USA.

Circle is also a highly respected name in the American crypto industry.

For crying out loud, Goldman Sachs backs Circle!

These features give USDC a more “squeaky clean” image versus USDT.

To relieve crypto traders, Grant Thornton issues attestations every month on the reserves for USDC.

Circle has also ordered third-party audits for further transparency.

So, yeah, it’s safe to say USDC is serious about compliance.

And these factors may be a significant driver of USDC’s growth in recent years.

Although USDC still isn’t as big as USDT, it has become a formidable challenger for the top position.

According to the most recent data, USDC has a market cap of about $50 billion.

How Do People Choose Between USDT vs. USDC?

As you’ve read through my overviews of USDT vs. USDC, you may have a clue how people choose between these coins.

If you don’t feel like reading anymore, here’s the TL;DR:

USDC is the “safer” option, but USDT is way more liquid.

Broadly speaking, short-term traders prefer the flexibility of USDT. By contrast, those interested in long-term passive income opportunities may feel more comfortable with USDC.

Determining the “better” stablecoin depends on what you want to do with it, what chain you’re on, and your risk tolerance.

If you’re still unsure how to choose between USDT vs. USDC, I’ve come up with four criteria to take a look at.

USDC vs. USDT — Which Is The Safer Choice?

I don’t think I’m being controversial when I say that Tether Limited is pretty sketchy.

Hey, I’m not saying Circle and Coinbase are “angels,” but they look pretty good by comparison.

So, from a safety standpoint, USDC always seems to score better when compared with USDT.

The biggest thing holding Tether’s reputation back is a formal audit.

Or a lack thereof.

If Tether Limited let an unbiased auditor check out its reserves, the crypto community might breathe a collective sigh of relief.

Or terror.

After all, what is it that Tether wants to hide?

Since Tether isn’t in the USA, it’s harder to hold them to US financial standards.

Also, please don’t forget that Tether got hacked for $30 million in 2017.

You could say that since Tether is still operating after all these years, they must be legit.

However, longevity doesn’t always translate to reliability.

Again, I’m not saying that USDC doesn’t have security concerns.

For instance, Circle has been known to freeze hundreds of thousands of USDC from holders’ accounts without forewarning.

These are the risks inherent in any centralized stablecoin — especially one that’s trying to be so well-liked by governments and mainstream companies like Visa.

Oh yeah, did I mention that USDC partnered with Visa and Crypto.com?

With partners that big, you know more regulators feel comfortable with USDC, which means there’s less risk of a surprise government crackdown.

So, until Tether Limited releases more unbiased data on its reserves, I feel less queasy using USDC.

USDC vs. USDT — Which Has The Best Price Stability?

The point of stablecoins is that they remain, well, stable!

However, as we recently saw with the Terra fiasco, there’s always a chance these tokens could lose their value.

If the organizations issuing stablecoins can’t handle the trading demand for their coins, then these tokens can lose their USD value (aka “de-pegging”).

The benefit of using centralized stablecoins like USDC and USDT is that they’re (theoretically) backed with equivalent fiat cash in a safe.

By contrast, algorithmic stablecoins like the one issued by Terra are based on a super-complicated arbitrage system that, unfortunately, often fail.

Since algorithmic stablecoins are so new and untested, they’re riskier than centralized options like USDC and USDT.

Crypto purists hope algo stablecoins will survive because they provide greater decentralization.

Unfortunately, at this point, that “decentralization” often leads to “destabilization.”

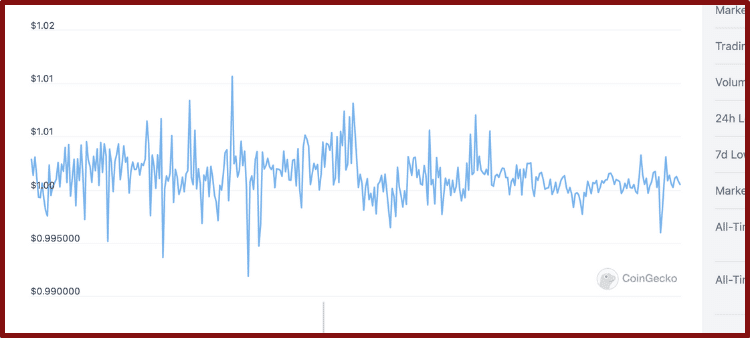

When we look at USDT and USDC’s stability over the years, they show minimal deviations from the 1:1 USD peg.

Sure, a long-term chart shows slightly more volatility with Tether, but you have to remember this crypto is more actively traded than USDC.

So, for the time being, I’ll say both of these cryptos tend to perform well in terms of price stability.

That doesn’t mean stability isn’t a concern for these projects, but they have shown impressive performance over the past few years.

USDC vs. USDT — What Offers Better Passive Income?

If passive income is your game, stablecoins have a lot to offer in CeFi and DeFi.

There are a lot of lending and borrowing platforms that accept USDC and USDT.

Heck, a few prominent exchanges offer interest accounts with these stablecoins.

For instance, if you’ve read my review of “Kraken vs. Gemini,” you may remember you can deposit USDC in a Gemini Earn account for passive income.

Other centralized sites like BlockFi, Celsius, and Nexo accept USDC and USDT for interest accounts or loans.

And that’s just a sampling of the stablecoin interest opportunities that await you!

If you’re comfortable with DeFi, you may want to consider investigating in liquidity pairs in decentralized exchanges like Uniswap.

There are also decentralized platforms like Aave that accept USDT and USDC for lending and borrowing.

Suffice to say that there’s a lot you could do with these stablecoins to earn passive income.

I can’t say one stablecoin is “better” than the other in this category.

It depends on how you’re planning to earn your yield.

In one sense, USDT is better because it’s available on more blockchains.

However, USDC’s relative security attracts long-term investors because there aren’t as many questions surrounding its reserves.

USDC vs. USDT — Which Has Better Liquidity?

Besides stability, stablecoins give crypto traders flexibility and liquidity.

Instead of finagling with frustrating fiat & fees, coins like USDC and USDT allow you to seamlessly swap in and out of crypto positions.

Although USDC has grown tremendously in recent years, USDT remains the most liquid stablecoin in the crypto industry.

Remember that USDT has been around since 2014.

That’s old in crypto terms.

Throughout those years, USDT has formed many partnerships with exchanges and blockchains.

Therefore, it’s easier to use USDT in DeFi and CeFi because it’s a prominent token.

USDC is still primarily used on Ethereum, but it’s slowly creeping into ecosystems like Solana and Algorand.

If USDC overtakes USDT in market cap, then I may have to revise this section.

However, as it stands today, USDT offers the greatest liquidity to crypto investors.

Therefore, if you’re deep into DeFi or perform many fast trades, USDT is probably the better bet.

How Do You Buy USDT or USDC?

There are dozens of places you could pick up USDT or USDC, but the most convenient method is to snag a few coins on a centralized exchange.

Like it or not, centralized exchanges help get people into crypto with their simple fiat onramps.

I’ve reviewed and compared a lot of exchanges over the years, but Coinbase is my favorite choice for beginners.

However, I understand how many people don’t enjoy the higher fees on Coinbase.

That’s why I put together a list of the “Top Alternatives to Coinbase” to give you more options.

Take your time reviewing my research on exchanges like KuCoin, Binance, and Gemini until you find one you enjoy.

Also, be sure to see whether your chosen exchange supports USDT or USDC.

Please don’t assume because USDC and USDT are so big that everyone offers them.

Some exchanges don’t like USDT’s shady reputation, while others don’t support the smaller USDC just yet.

After signing up for an exchange, follow the instructions to send money via an ACH or wire transfer from your bank.

You may also be able to send money with a debit or credit card, but this tends to cost absurdly high fees.

When you have fiat in your account, you should be able to swap for USDC or USDT.

You could then transfer your tokens to a private wallet like MetaMask or Trust Wallet, or just leave them on the exchange.

Remember that tokens on a centralized exchange aren’t entirely under your control. If you want full custody of your stablecoins, you need to transfer them to a private wallet.

For more on this topic, read my comparison of “Exchange vs. Crypto Wallets.”

USDC vs. USDT — What’s My Pick For The Best Stablecoin?

If you couldn’t already tell, I prefer using USDC over USDT.

Just like I enjoy using Coinbase for its high-quality compliance standards, I enjoy USDC’s safety record.

While USDC isn’t the most liquid stablecoin, it’s pretty flexible in today’s crypto market.

As USDC’s market cap expands, I can’t see it getting any “less liquid.”

Unless Tether can assure the crypto industry it has every dollar it issues in digital tokens, there will be lingering doubts surrounding this company.

I’d rather place my faith in a US-based stablecoin with a long history of audits.

Please don’t get me wrong; I’m not saying that Tether isn’t legit.

For the time being, I just feel more comfortable with USDC’s track record.

And, considering how fast USDC’s market cap is climbing, I don’t think I’m the only one that feels this way!

Although I prefer using USDC, I’d encourage you to research all of the stablecoins on today’s market.

Every stablecoin has strengths and weaknesses, and I get how some people prefer the decentralization of Dai over USDC.

Just remember that stablecoins have risks and tax implications!

Please let the UST disaster serve as a cautionary tale before you put too much of your net worth into stablecoin investments.