For many crypto investors, smart contracts are the greatest thing since sliced bread.

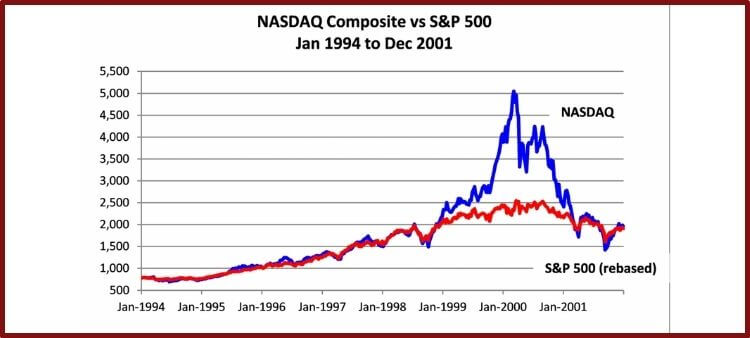

Just pull up a price chart of any smart contract token, and you can see there’s plenty of excitement in this market.

So, is all the speculation for real?

Are smart contracts the way of the future?

Or are these platforms doomed to crash “dot-com bubble style?”

Since smart contracts are so new, it’s difficult to tell whether the hype is genuine or just “hopium.”

However, there’s no question that smart contracts could revolutionize many industries.

It’s also clear that many companies and big-name investors are placing huge bets on this innovation.

But before you go “gung-ho” into crypto, please know that every smart contract platform is slightly different.

You should have a firm understanding of each project’s core features before investing.

In this post, I’ll try to give you a straightforward understanding of four top-performing smart contract platforms.

Hopefully, this info will serve as a beginner-friendly intro to the major players in the smart contract game.

Hold On, Spencer! Could You Explain “Smart Contracts?”

Crypto concepts can get super complicated really fast.

In fact, I meet many people who feel they need to be a techie before getting involved in crypto.

While there’s a lot of high-IQ code that goes into crypto, there are simple ways to understand topics like smart contracts.

If you’ve read my posts on Ankr and Telcoin, then you know I love trying to simplify challenging concepts into one memorable sentence.

Well, I think I’ve got a pretty good one for smart contracts!

When you think of “smart contracts,” remember the phrase “automated agreements!”

OK, I know that doesn’t “fully” explain smart contracts, but I think it’s an excellent way to wrap your head around this concept.

Smart contracts are similar to legally-binding agreements you’d make in the real world—except there’s no third-party involved.

Instead of relying on lawyers to give a “seal of approval,” smart contracts operate on code.

Just like Bitcoin doesn’t need a central bank, smart contract platforms operate in a trustless manner on the blockchain.

Participants in each smart contract system take care of the validation process with built-in consensus algorithms.

So, whether you want to buy an NFT, loan crypto, or earn interest in staking pools, all of these functions execute without a central authority.

Once the conditions of a smart contract’s code are met, it will “automatically” set the “agreement” in motion.

Superstar Smart Contract Networks — A Review Of The Biggest Smart Contract Cryptos

Ethereum

Even if Ethereum goes to zero, nobody could explain smart contracts without mentioning it.

Why?

Because Ethereum invented smart contracts!

Created in 2013 by Vitalik Buterin, Ethereum offers developers a platform to develop decentralized apps (aka dApps).

So, the Ethereum network is like today’s web browser, but without centralized authorities running sites.

Instead, Etheruem “works” using Bitcoin’s Proof of Work algorithm.

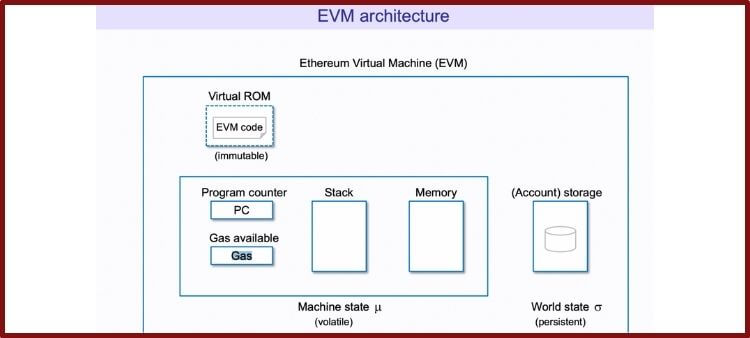

Millions of computers worldwide are now powering the Ethereum Virtual Machine (EVM). Network participants use their computing power to make new blocks, validate transactions, and earn mining rewards.

Ethereum coders use a new language called “Solidity” to write their dApps and smart contracts on the Ethereum network.

To this day, Ethereum is the leader in the smart contract game, and it has all of the hottest dApps and NFT markets.

Just a few of the biggest crypto sites on Ethereum include:

- Uniswap

- Aave

- OpenSea

- Curve

- Compound

Also, many of the biggest altcoin projects are built on Ethereum, including:

- Chainlink

- Basic Attention Token

- USDC

- Shiba Inu

OK, so what’s the point of the “Ether” cryptocurrency?

Basically, people use Ether to pay fees (aka “gas”) on the Ethereum network. These fees help incentivize ETH miners to continue chugging along with their computing power.

Even with all the competition in the crypto space, Ethereum has roughly 50 percent of the total value locked (TVL) on DeFi.

DeFi Llama now estimates Ethereum has a TVL score above $100 billion!

While it’s unlikely anyone will overtake Ethereum in the near term, that doesn’t mean this chain is issue-free.

Most notably, many people don’t like using Ethereum because the gas fees are so high.

Also, Ethereum’s Proof of Work model isn’t the most eco-friendly.

To address these issues, Ethereum is working on a “2.0” upgrade that will phase out Proof of Work for Proof of Stake.

Ethereum developers will also introduce “sharding,” which should help streamline transactions and cut down on fees.

If you’re going to invest in Ethereum, you’ve got to feel confident Vitalk’s team can make good on this upgrade.

For more info on how to buy Ethereum, please check out my previous post, “Buying Ethereum on PayPal.”

Side Note: What’s The Deal With Ethereum Classic?

Unfortunately, it’s easy for new investors to mistake “Ethereum” for “Ethereum Classic.”

Although Ethereum Classic may sound more authentic, it’s actually a way smaller altcoin versus “Ethereum.”

Interestingly, Ethereum Classic (ticker: ETC) is the unmodified original Ethereum chain (hence the name!).

The reason these chains split had to do with an epic episode in cryptocurrency history: the 2016 DAO Hack.

To make a long story short, investors lost roughly $150 million in ETH because hackers noticed weak points in the DAO’s smart contract code.

Some developers said they needed to re-write this code to recover lost funds.

Others argued that re-writing the code would go against the mantra “code is law!” While this hack was a regrettable incident, these developers felt it would set a bad precedent for Ethereum’s decentralization.

Those who decided to “fork” the Ethereum chain created the Ethereum we know today. Those that remained on the original Ethereum got rebranded as Ethereum Classic.

Unless you’re a true believer in Ethereum Classic, chances are you’re more interested in Ether (ticker: ETH). Please always double-check your wallet addresses and cryptocurrency names to avoid mixing up ETH with ETC.

Binance Smart Chain

As you may recall from my comparison article “Binance vs. KuCoin,” Binance is the largest crypto exchange on earth.

Arguably, a large part of Binance’s recent growth has to do with its smokin’ hot Binance Smart Chain.

This smart contract platform is a copy of Ethereum, but it’s more centralized.

The BSC runs on a “Delegated Proof of Stake” model where only a handful of wealthy BNB holders determine the direction of this blockchain.

There are pros and cons to this model.

On the pro side, transactions are cheaper, faster, and more eco-friendly than on Ethereum.

On the downside, the BSC goes against the ethos of decentralization.

After all, Binance basically controls the BSC, so it’s not much different from working with a centralized authority.

Still, there’s no denying the BSC is super popular, cheap, and user-friendly.

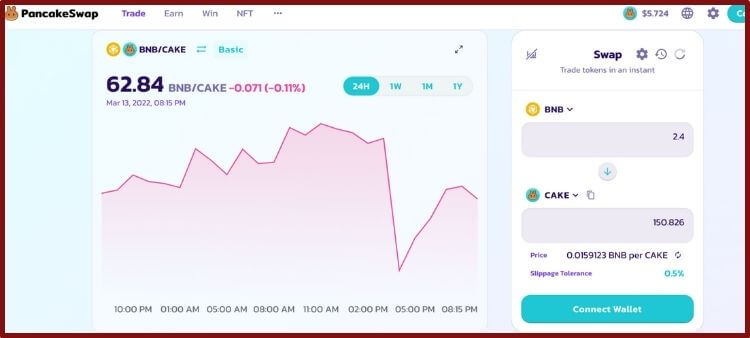

Plus, BSC’s dApps like Pancake Swap easily integrate with the MetaMask wallet.

To download a MetaMask wallet, please click this link.

If you’re bullish on BSC—or you want to try out this platform—consider adding BNB tokens to your portfolio.

Solana

Solana is one of the newest smart contract blockchains, but it has made a big impression in the crypto space.

Developed by Anatoly Yakavenko, Solana’s main selling point is its new consensus algorithm: Proof of History.

This riff on the Proof of Stake system allows Solana’s nodes to process transactions at lightning-fast speeds with minimal fees.

One major reason Solana gained so much mainstream attention is because it’s closely tied with the FTX exchange.

Also, many big-shot venture capitalists have been reaping the rewards of Solana’s recent success.

However, there are concerns to consider before exploring Solana’s network.

Most notably, Solana has a history of crashes, bugs, and DDoS attacks.

Also, it’s super early in Solana’s history.

Even though Solana has been out a few years, it’s still technically in beta.

Could Solana surpass Ethereum?

Sure.

But please do your research on the pros and cons of this blockchain before investing in SOL.

Cardano

Cardano lives by the adage “slow and steady.”

Created by ex-Ethereum developer Charles Hoskinson, Cardano takes a deliberately scientific approach to its smart contract platform.

For supporters, this well-planned-out method will create an invulnerable Proof of Stake blockchain.

For critics, Cardano is moving way too slow to compete with other chains.

It seems like every crypto investor has a strong opinion on Cardano’s future and the price potential of its native ADA token.

To be fair, Cardano has smart contract functions, and it landed a significant partnership with the Ethiopian government.

The good news for ADA supporters is that you can stake your tokens for decent rewards on-chain.

Just be sure to watch a few of Charles Hoskinson’s popular YouTube videos if you’re on the fence about this project.

You should also look at Cardano’s roadmap to understand the upcoming milestones, previous accomplishments, and estimated completion date.

Reading through all this data should give you a sense of whether Cardano will be a worthy competitor to Ethereum.

So, What Smart Contract System Reigns Supreme?

Smart contract blockchains have a ton of potential…but they also have a lot of competition.

There are dozens of promising chains I didn’t even get to mention.

For instance, Terra, Avalanche, and Fantom have made considerable gains in recent months.

Also, blockchains like Polygon are helping reduce the cost burden on Ethereum’s blockchain.

While these chains are exciting, please remember they’re highly speculative.

If you want to be a “conservative” smart contract investor, I’d highly recommend sticking with Ethereum.

That doesn’t mean other smart contracts can’t be successful—but they probably will be more volatile.

And, as everyone knows about crypto, even coins like Bitcoin and Ethereum could have wild price swings.

As always, please do plenty of research into smart contract platforms before making a rash decision.

FYI: You could buy any of the tokens above by signing up for Coinbase on this link .

Want to learn how I make money using crypto? Check out my favorite node project here.