Ankr may have a seafaring name, but this altcoin is all about the skies. To be more specific, Ankr is focused on cloud computing.

Co-founded by a former Amazon employee, the Ankr team wants to create a decentralized, blockchain-based rival to AWS.

Yes, that’s as ambitious as it sounds!

People who use Ankr’s network could lend unused cloud computing power to people who want it.

Ankr incentivizes businesses to “donate” their extra power with its Ankr token.

As if that wasn’t enough, Ankr also wants to democratize DeFi staking.

There’s no question Ankr has lofty goals, and it has already attracted a lot of cash from early investors.

So, does Ankr have a chance to dominate DeFi? Or, will Ankr’s token drop like, well, an anchor?

Truthfully, I can’t answer that question…because nobody can!

Small altcoins like Ankr, XRP, and Telcoin have a lot of potential, but there are plenty of competitors in the cryptosphere.

Also, since altcoins are inherently speculative, it’s hard to get a solid read on Ankr’s valuation.

If you’re thinking about adding Ankr to your portfolio, please remember that all altcoins are high-risk bets. Even coins with seemingly great fundamentals could get you rekt.

Is Ankr A Good Investment? — What Features Set Ankr Apart?

Ankr is one of the countless crypto projects that first emerged in 2017.

All three of Ankr’s core developers went to school at UC Berkeley, and one (Stanley Wu) has experience working for Amazon AWS.

In its first few years of operation, Ankr was laser-focused on using blockchain tech to enhance cloud computing.

If companies had computing power they weren’t using, they could “lend it” through the Ankr network to customers who could use it.

This helps customers use the cloud for a relatively cheap fee. Plus, cloud providers get passive income for their service in the form of Ankr tokens.

As Web3 tech progressed in recent years, Ankr has shifted its focus to decentralized finance (DeFi).

As you browse Ankr’s website, it’s clear this crypto wants to be a hub for popular staking pools.

Indeed, one of Ankr’s most hyped features is its “StakeFi Platform.”

To put it simply, StakeFi helps the average Joe earn interest on popular Proof of Stake cryptos.

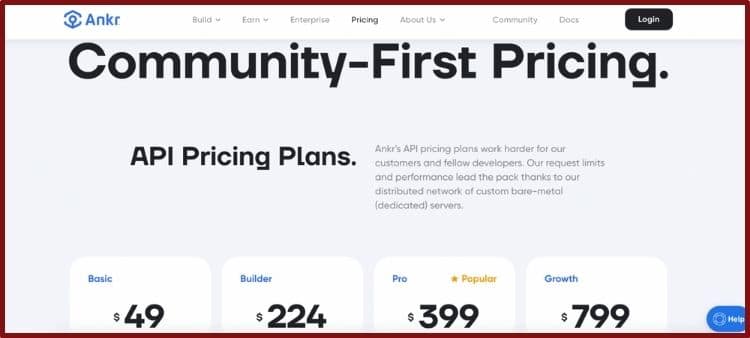

Ankr can help anyone launch a node on big-name blockchains for a monthly fee.

A few of the largest coins now available on StakeFi include:

- Ethereum

- Avalanche

- Kusama

- Polkadot

Speaking of Polkadot, Ankr also offers “bonding” services for folks interested in parachain auctions.

Beyond staking and cloud computing, Ankr has its own API for DeFi developers.

Ankr’s API should make it easier for dApp devs to interact with the world’s top smart contract blockchains.

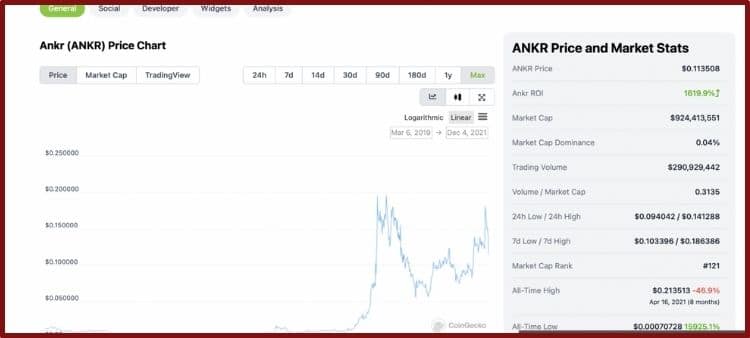

As of 2021, Ankr has a max token supply of 10,000,000,000.

Anyone could stay up-to-date with Ankr’s development by following their Twitter, Telegram, or GitHub pages.

What Are The Benefits Of Buying Ankr Tokens?

Even if you’re not super tech-savvy, it’s easy to see the value of Ankr’s services.

For starters, this crypto project could make cloud computing more accessible and reduce unnecessary waste at massive data centers.

Unlike Bitcoin, it’s unlikely green activists will ever come after Ankr!

Plus, Ankr’s StakeFi and API offer easy on-ramps to the world of DeFi.

You don’t need to put up 32 ETH to operate a node on the Ethereum 2.0 Beacon chain.

Anyone could stake ETH through Ankr to receive a synthetic version of Ether.

Since you need the Ankr token to take advantage of this network, the price of ANKR should reflect its network activity.

If Web3 continues to grow—and if Ankr can build its brand awareness—it could mean great things for this token’s price.

Although the Ankr token has shot up in 2021, it’s still a small-cap crypto. This could give early investors a chance to get in on the ground floor.

But you don’t have to be an investor to take advantage of all Ankr has to offer.

For instance, if you already hold other tokens like DOT or AVAX, you could use Ankr tokens in StakeFi.

Also, the more Ankr tokens you hold, the more you could participate in the project’s governance.

Anyone involved in Web3 and DeFi could get a lot of use out of their Ankr tokens.

Who’s The Ideal Ankr Investor?

As you’re researching various altcoins, please remember these wise words:

“Only invest in coins you understand!”

I know; the FOMO can be intolerable at times.

However, if you don’t have a firm grasp of concepts like staking or DeFi, it may be too early to invest in Ankr.

People who know the issues Ankr is trying to fix will feel more comfortable investing in this token.

For this reason, I’d only recommend people who are deeply immersed in Web3 or cloud infrastructure to get involved with Ankr.

You may also want to “test” Ankr’s services by interacting with StakeFi.

If you have good experiences with Ankr’s products, it should bolster your conviction in this project.

Just remember that Ankr is a high-risk investment.

Smaller tokens are always more volatile than big-caps.

Even if you believe Ankr has a bright future, you must prepare yourself for massive price swings in the short term.

Please bear this in mind before putting any money into Ankr tokens.

How Do People Buy Ankr Tokens?

Let’s say you’ve done your research on Ankr, and now you’re ready to invest.

At this point, you’re probably wondering: “Where the heck could I buy some Ankr?”

For US customers, the choice is obvious:

Coinbase.

To this day, Coinbase is the largest American exchange that offers Ankr tokens.

Even if you live in a US state that’s not keen on crypto, you shouldn’t have an issue creating a Coinbase account.

If you aren’t already on Coinbase, be sure to click this link.

However, you could also find Ankr tokens on Binance and Binance.us.

I’ve also seen Ankr listed on the popular site KuCoin.

FYI: If you’re curious about my opinion on either of these exchanges, be sure to check out my review: below:

Are There Any Alternatives To Ankr?

Ankr may seem like a niche crypto, but many other projects are in the decentralized cloud space.

Arguably, the Akash Network is most similar to Ankr.

Heck, even the names of these coins are kind of similar!

On Akash’s main website, developers clearly state they want to use “underutilized cloud capacity” to compete with centralized cloud companies.

That sounds almost identical to Ankr’s original mission, doesn’t it?

Siacoin is yet another cryptocurrency that’s often compared with Ankr.

Since 2015, Siacoin has been interested in creating a decentralized solution for cloud data storage.

Lastly, some people compare Dfinity’s Internet Computer (aka ICP) with Ankr. Based in Switzerland, ICP is a highly complex project that wants to decentralize the entire Internet.

Since ICP relies heavily on data centers, some people often compare it with Ankr.

Of course, as crypto technologies advance, there’s always the threat that Ankr’s services won’t be as attractive to users.

For instance, will people care about using Ankr’s StakeFi when Ethereum 2.0 gets released?

Also, there’s no saying another team can’t develop a better cloud or node hosting service.

New investors must consider these competitors and issues when buying Ankr tokens.

The Pros & Cons Of Investing In Ankr

To make your decision a little simpler, here’s a roundup of the top pros and cons of investing in the Ankr token.

Ankr Pros

- Eco-friendly cloud storage solution.

- StakeFi Program helps users earn interest in popular cryptos.

- Attractive API for dApp developers.

- American-based crypto with a solid team of developers.

Ankr Cons

- Faces competition from both centralized and decentralized cloud companies.

- Speculative small-cap coin with high volatility.

- Not suited for investors who don’t know about Web3 or cloud computing.

So, Is Ankr A Good Investment? — A Few Final Thoughts

Ankr started as a pure “decentralized cloud” play, but it has become a significant DeFi staking platform.

With its API and StakeFi offerings, there’s a good chance Ankr could provide a real need as Web3 develops.

Indeed, since you could use Ankr to interact with these services, these tokens have a strong use case.

As long as more people start using Ankr, you can expect this crypto to rise.

But that’s the big question: Just how big could Ankr grow?

Ankr has to compete with both centralized cloud companies and decentralized crypto projects.

There’s also no telling how popular Ankr will be as Web3 evolves.

Ultimately, whether Ankr is a good investment depends on your risk tolerance and belief in the project.

If you’re already interested in protocols like Ethereum or Polkadot, then Ankr may be extra attractive for you.

Indeed, you may want to buy Ankr tokens solely to interact with its StakeFi offering.

As far as altcoins go, Ankr has a lot of promise—but it will likely face a few sharp corrections along the way.

I’d only recommend investing in Ankr if you have a solid understanding of its offerings and a strong stomach.

As always, please don’t invest more than you’re willing to lose!

Check out my other reviews:

Looking for the best crypto wallet? Check out my review of MetaMask Vs. Trust Wallet.