There’s no question that Coinbase commands the US crypto exchange market.

With roughly 98 million users on its platform, Coinbase has plenty of clout in cryptocurrency.

However, that doesn’t mean you should feel beholden to Coinbase to get your Bitcoin.

Competition in the crypto industry is fierce, and investors have more options to trade virtual currencies.

For instance, the platform Coinify has emerged as an increasingly popular choice with crypto fans.

To be fair, Coinify has been a super successful company for many years. However, it’s taking a while to catch on in the USA.

You see, Coinify’s homebase is in Copenhagen, and it still caters to European clientele.

If you go on Coinify’s website, it proudly claims it’s Europe’s top “virtual currency payment service provider.”

However, in 2021, Voyager Digital bought Coinify in a massive stock deal.

Yes, this is the Voyager company that owns the popular crypto broker app.

So, what does Coinify have to offer that you can’t find on Coinbase?

Most significantly, which of these platforms suits your crypto trading needs?

Coinbase vs. Coinify — Comparing Two Classic Crypto Trading Sites

- Availability

- Ease of Set Up

- Security

- Ease of Use

- Access to Cryptocurrencies

- Customer Service

- Trading Fees

- Passive Income

Availability

Both Coinify and Coinbase are global brands, but they have unique target areas.

Since Coinify is in Denmark, it has always placed great importance on the European market.

Many of the compliance standards Coinify has are in the European Union, so you’ll see way more European countries on Coinify’s “supported” list.

By contrast, Coinbase has always been interested in complying with regulators in the good old US of A.

So, even though both of these companies operate in over 100 countries, Coinify has fewer options in the USA.

This doesn’t mean Americans can’t use Coinify, but there are less available states on this platform’s list.

For instance, when I looked through Coinify’s availability page, I discovered states like Alabama, Alaska, Connecticut, and Georgia didn’t make the cut. And there are many more.

Of course, New Yorkers also can’t access Coinify — but that’s not surprising if you know the Empire State’s infamous BitLicense policy.

If you’re a crypto fan in New York, I’d advise reading this previous post to learn how to buy popular coins.

On the flipside, Hawaii is the only state that can’t access Coinbase.

“E kala mai” to investors in the Aloha State!

Since both Coinbase and Coinify operate in over 100 countries, it’s hard to say which is “better” for availability.

Of course, it all depends on where you live.

As it stands today, Coinbase is the better option for availability in America.

However, please read Coinify’s official list before signing up to see if they’ll allow you on their site.

Winner: Coinbase for American investors

Ease of Set Up

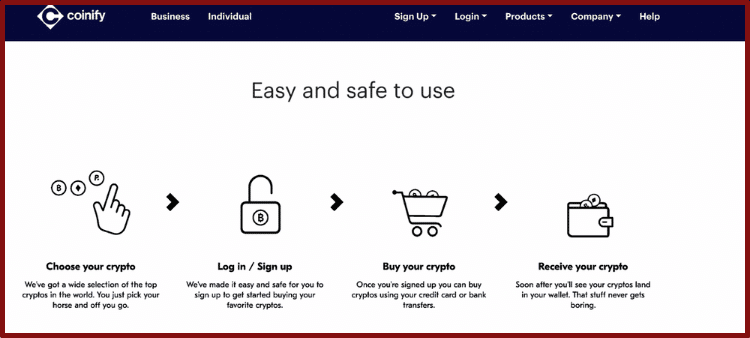

Coinify and Coinbase are extremely beginner-friendly sites.

Both companies want to make using and trading crypto simple for the average Joe, so you shouldn’t have problems signing up for these platforms.

Remember that Coinify and Coinbase put compliance first, which means you’ll have to give over KYC info.

This will include your name, an email, and photo verification.

Those who aren’t comfortable handing over KYC data may want to check out my previous review of KuCoin.

However, as long as you’re OK with standard KYC requirements, it’s simple to set up an account on Coinify and Coinbase.

Winner: Draw

Security

Yet again, Coinbase and Coinify have similar security standards.

Even though hackers got into Coinbase in 2021, it quickly patched up the SMS error and paid all of the affected customers.

Currently, Coinbase remains one of the world’s leading institutional crypto custodians.

The Coinbase team claims to keep most of its crypto in cold storage, and it offers US users FDIC insurance on USD.

To guard against future hacks, Coinbase uses advanced encryption technology. It also carries millions in insurance in case of a severe data breach.

As for Coinify, this company has a ton of EU regulations to ensure it’s on the up and up.

The Coinify team also has accreditations from the UN Global Compact and Forbes.

Unlike Coinbase, Coinify is a “wallet-independent” platform.

So, unlike Coinbase, Coinify doesn’t directly hold digital assets.

Like Voyager, Coinify will facilitate transfers between digital assets and send them to your private wallet.

Speaking of Voyager, it’s worth mentioning that Voyager Digital is a publicly-traded company, so you could review Coinify’s financials.

The same goes for Coinbase.

Also, Voyager Digital provides FDIC insurance via the Voyager app, but it’s unclear if these protections transfer to American Coinify users.

So, if you’d like the assurance of insurance protections in the USA, I’d say Coinbase is the better bet.

However, both of these companies have long & successful track records for safety standards.

Winner: Coinbase for US investors

Ease of Use

As I mentioned in the “set up” section, Coinify and Coinbase want to make it easy for newbies to get into crypto.

The UI/UX on both of these sites is incredibly intuitive.

Whether you want to make a trade, withdraw, or deposit, you’ll see clear tabs on your account page.

Both platforms support bank and crypto transfers as well as credit card transactions.

For extra convenience, Coinbase offers PayPal deposits for a higher processing fee.

However, just remember what I said earlier about Coinify being a “wallet-independent platform.”

People new to crypto may not understand what that means, so you should review my guide to “Crypto Wallet vs. Exchange Wallet” for more info.

In brief, you need to already have a private crypto wallet to interact with Coinify.

Thankfully, Coinify has a partnership with the hardware wallet manufacturer Ledger.

So, if you buy a Ledger device, you could easily sync it with Coinify.

While I always recommend hardware wallets for increased security, you could also use free hot wallets like Trust Wallet or MetaMask with ease.

Heck, you could even use the non-custodial Coinbase Wallet without having a Coinbase account!

While both of these platforms are easy to use, I will give this category to Coinbase.

Why?

First off, Coinbase has virtually zero learning curve and more payment options.

Second, people on Coinbase can synch their non-custodial Coinbase Wallet app with their exchange.

Third, Coinbase gives users access to the standard Coinbase and the more advanced Coinbase Pro.

I get it: Coinbase Pro isn’t “easy to use.”

However, it’s nice for Coinbase customers to know they’ll have another option for crypto trading as they get more comfortable.

Coinbase Pro offers more attractive features like detailed trading charts, limit orders, and lower fees.

So, overall, I feel like Coinbase’s extra options push it ahead of Coinify.

Winner: Coinbase

Access to Cryptocurrencies

Altcoin fans often criticize Coinbase for being too “late” to adopt low-cap crypto projects.

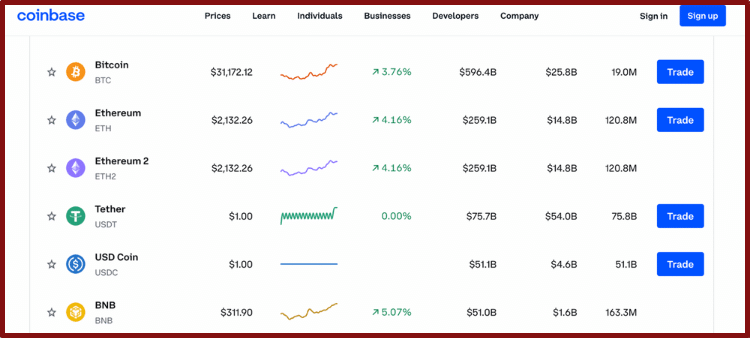

While Coinbase doesn’t have as many tokens as Binance or KuCoin, it has expanded its portfolio a lot in recent years.

Currently, you can find over 100 cryptos on Coinbase.

Unless you’re a serious “altcoin hunter,” I doubt you’ll have issues finding the token you want with a Coinbase account.

OK, how does Coinify compare?

According to Coinify’s trading portal, there are roughly 20 digital assets available.

These tokens include the big boys like Bitcoin and Ethereum, plus other large to mid-cap tokens.

You could also trade your fiat into stablecoins like USDC and Tether via Coinify.

Clearly, Coinbase has more crypto options for investors, but Coinify may be OK if you like to keep things simple.

Be sure the crypto you want is on Coinify’s list before hopping on the platform.

Winner: Coinbase

Customer Service

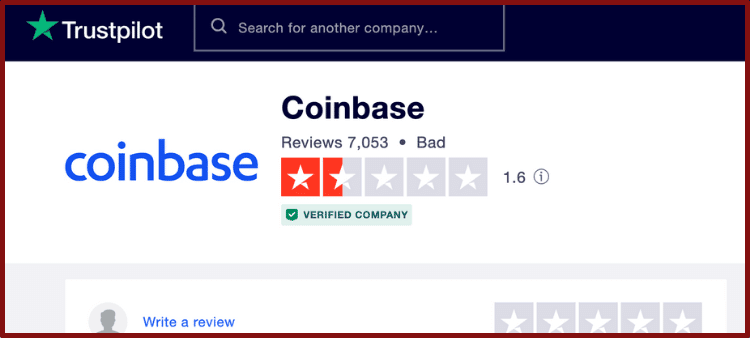

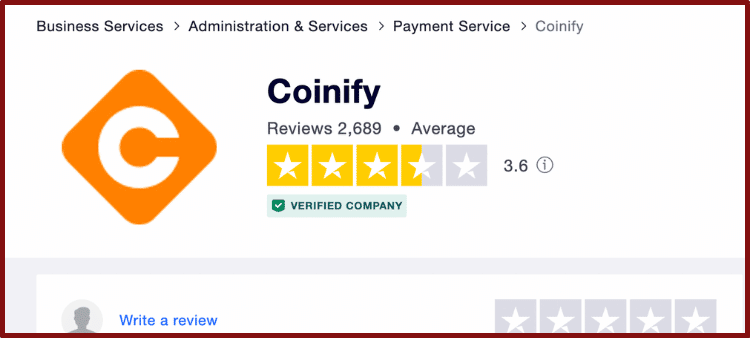

Besides Kraken, I can’t think of a crypto exchange with a “good reputation” for customer service.

You’d think that Coinbase would have a stellar customer service department given its massive size.

Although Coinbase has been investing in improving its customer care standards, it still has an abysmally low rating on TrustPilot.

While Coinify’s TrustPilot score isn’t super high, it’s way better than Coinbase.

Of course, you also have to consider Coinify has a smaller user base, and it tends to focus most of its energy on crypto-friendly merchants in Europe.

You shouldn’t expect a rapid response if you need to get in touch with Coinbase or Coinify.

Typically, you’ll have to wait a few business days to hear back via ticketed support.

In the meantime, I’d recommend checking out the FAQs in Coinbase and Coinify’s online help centers.

Also, Coinbase now offers live phone support.

As a bonus, if you get the Coinbase debit card, you should enjoy priority phone service.

Given these extra options and Coinbase’s larger size, I’m going to give it a slight edge in this category.

However, I’m fully aware that customer service standards are still far from ideal at Brian Armstrong’s company!

Winner: Coinbase

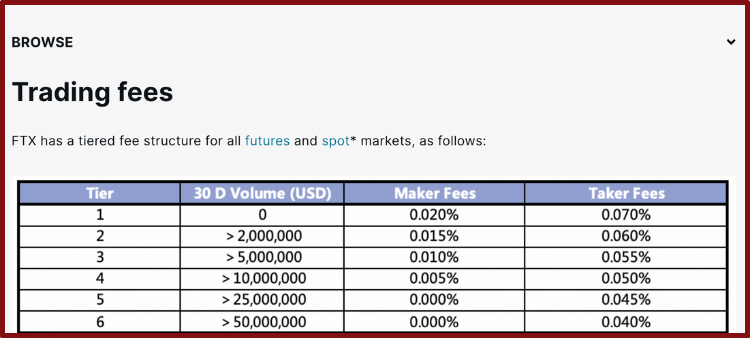

Trading Fees

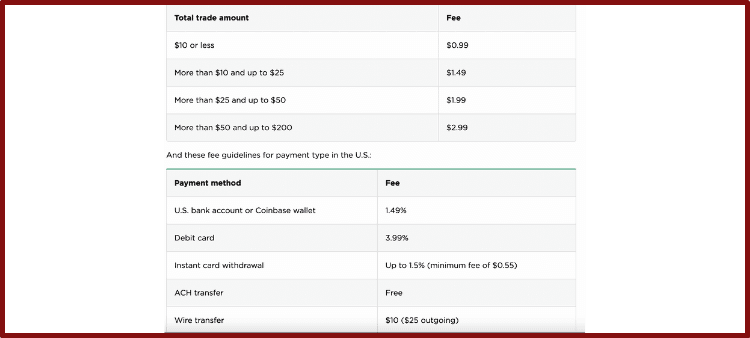

I’ll be straight with you: Figuring out fees on Coinbase and Coinify is complicated!

There are so many extra charges on your crypto that it’s almost comical.

However, you’d better prepare for high transaction costs no matter which platform you use.

Coinbase always charges a spread of 0.5 percent on its standard site, but it will tack on extra convenience fees depending on how much you spend.

Also, don’t forget that Coinbase charges 3.99 percent if you use a card or PayPal. You’ll also face transaction fees for wire transfers, so I always advise going with ACH to save some cash.

While Coinbase is a pricey platform, Coinify isn’t a “bargain” in the fee department.

Indeed, this company charges processing fees of up to 5 percent on card transactions or 1 percent for bank transfers.

You’ll also have to factor in buy & sell fees plus regular network fees.

Thankfully, you don’t have to worry about withdrawal fees since Coinify will send your crypto into a private wallet.

The “no-brainer” way to avoid all of these fees is to look into another exchange like Binance, FTX, or KuCoin.

However, Coinbase has one way you could dramatically bring your total trading fees down.

Remember how I said Coinbase users enjoy access to a Coinbase Pro account

On Coinbase Pro, you only have to pay a maker or taker fee.

All transactions under $10,000 on Coinbase Pro have a flat fee of 0.6 percent (taker) or 0.4 percent (maker).

That’s it.

Granted, this fee is super high if you compare it with FTX or Binance, but it’s better than Coinbase Standard and Coinify.

For this reason, I’m going to give this category to Coinbase.

Winner: Coinbase

Passive Income

To be honest, I don’t see any way you could make passive income on Coinify.

However, that makes sense because Coinify doesn’t target retail investors.

Sure, Coinify allows people to buy crypto, but it’s not a “trading platform” per se.

If you watch Coinify’s official promo, the company’s leaders directly say Coinify is “foremost a payment company” for “PSPs and merchants.”

Individual crypto investing and trading is available on Coinify, but they aren’t as concerned with this feature.

By contrast, Coinbase has a plethora of ways you could make your crypto work for you on its main website and its non-custodial wallet.

For instance, you could stake tokens like Ethereum, Algorand, or Tezos to earn rewards.

Coinbase also has a neat “Learn to Earn” account where you could get paid in crypto to watch short videos.

Plus, as I hinted above, Coinbase now has a debit card that rewards customers in crypto.

Even though the Voyager app is known for its impressive interest accounts, this feature hasn’t made its way onto Coinify.

Therefore, if you’re looking for a platform that has passive income opportunities, Coinbase is the better choice.

Winner: Coinbase

Coinbase Still Crushes It, But Coinify Is A Valid Option!

Was I too harsh on Coinify?

Or was my comparison too biased towards Coinbase?

I’ll admit, I’ve enjoyed using Coinbase for many years.

Plus, if you’re a crypto trader or investor, I feel like Coinbase has so many better features.

However, there are some cases where Coinify may be the better option for you.

Most significantly, if you’re a business or employer interested in using crypto, Coinify has a lot to love.

Of course, Coinbase has its “Commerce” feature for merchants, but Coinify is more focused on the B2B side of crypto adoption.

Also, if you’re reading this article in Europe, you may feel more comfortable with Coinify’s EU accreditations.

Honestly, you can’t go “wrong” with these crypto platforms.

I just feel like most of my readers will get more out of a Coinbase account versus Coinify.

But, who knows; since Voyager Digital owns Coinify, we may see some interesting integrations with the Voyager app!

If you’re still not sold on either Coinbase or Coinify, I recommend checking out my previous article on the “Best Coinbase Alternatives” for more ideas.