When it comes to managing your personal finances, it can be overwhelming to decide which software to use. YNAB vs Quicken is a popular comparison, as both have their pros and cons.

YNAB stands for You Need A Budget, while Quicken is a long-standing finance software.

In this blog post, we will compare both programs to help you decide which one is better for reaching your financial goals. YNAB vs Quicken – let’s find out which one wins in this showdown!

What is YNAB and Quicken?

When it comes to managing your personal finances, it can be overwhelming to decide which software to use. That’s where YNAB and Quicken come in.

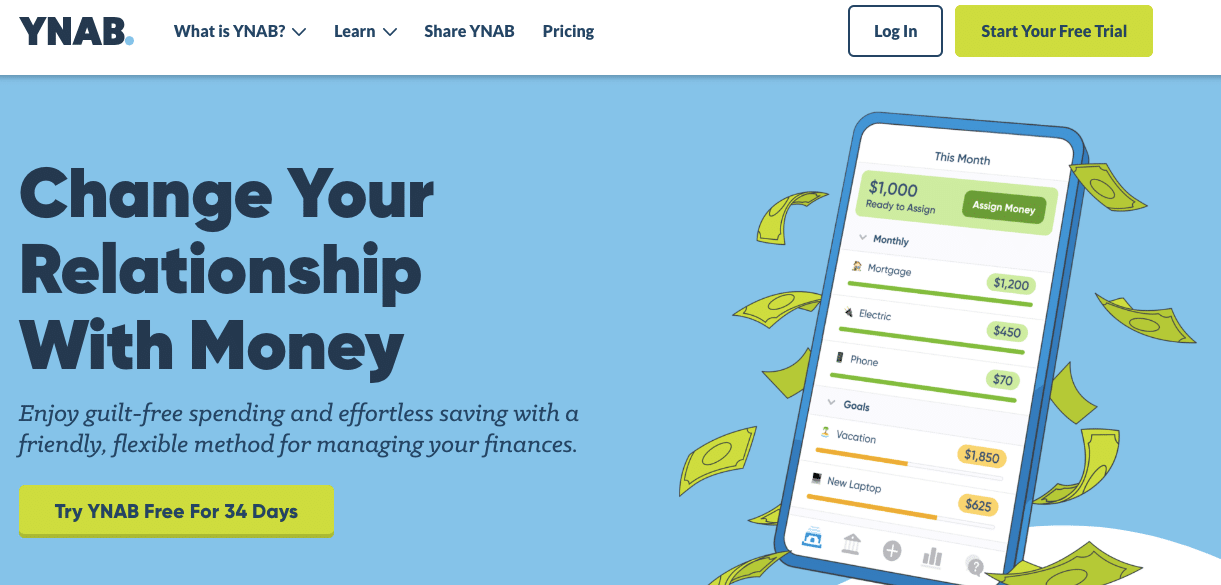

YNAB, which stands for You Need A Budget, is a popular budgeting app that focuses on helping users create and stick to a budget.

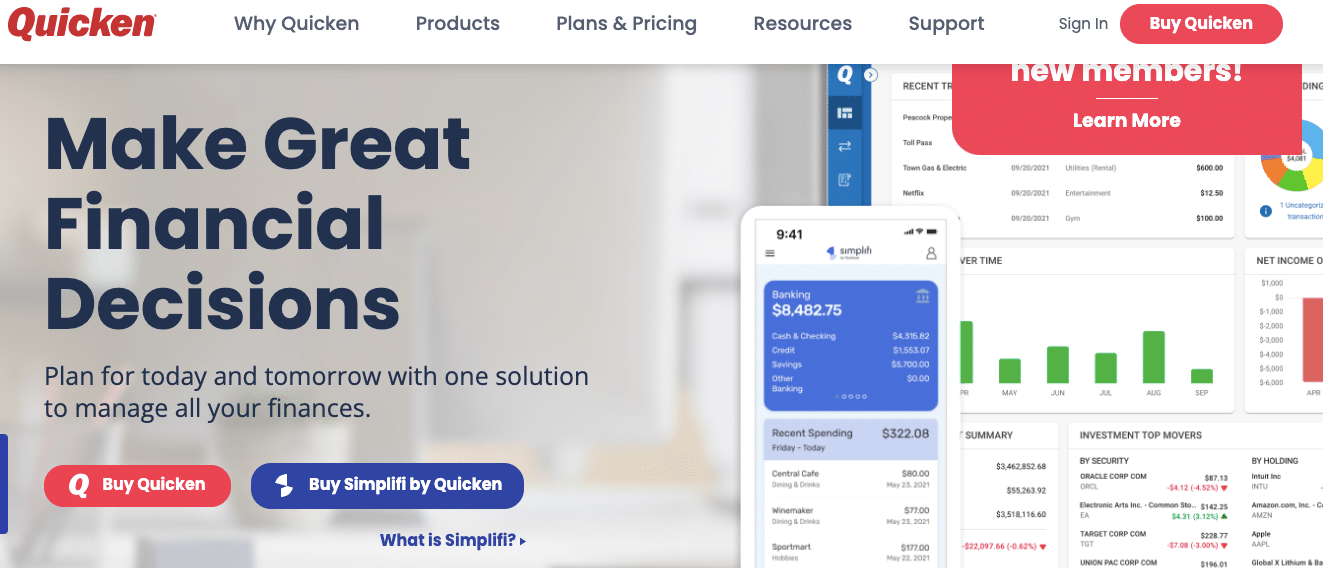

Quicken, on the other hand, is a long-standing finance software that offers a wide range of features for tracking and managing your finances.

YNAB takes a proactive approach to budgeting by encouraging users to assign every dollar a job. It emphasizes the importance of prioritizing your spending and staying on top of your financial goals.

Quicken, on the other hand, offers a more comprehensive set of features, including investment tracking, bill payment reminders, and tax planning tools.

Both YNAB and Quicken have their own unique features and benefits, so it’s important to consider your personal financial goals and needs when choosing between the two.

YNAB is great for those who are looking to take control of their spending and get out of debt. Quicken, on the other hand, is better suited for those who have more complex financial situations, such as multiple accounts or investments.

Features of YNAB

YNAB (You Need A Budget) offers a range of features that can help you take control of your finances. One of its standout features is its emphasis on budgeting.

With YNAB, you assign every dollar a job, so you have a clear picture of where your money is going. This can be a game-changer if you struggle with overspending or find it hard to stick to a budget.

Another great feature of YNAB is its goal-setting capability. You can set specific financial goals, such as paying off debt or saving for a vacation, and YNAB will help you stay on track by tracking your progress and providing regular updates.

This can be a real motivator and can help you stay focused on your goals.

YNAB also offers excellent reporting features. It provides detailed reports on your spending habits, income, and expenses, allowing you to identify areas where you can cut back and save more. This can be incredibly helpful when trying to optimize your budget and make smarter financial decisions.

Additionally, YNAB has a user-friendly interface that is easy to navigate. It has a clean and modern design, and its mobile app allows you to manage your finances on the go.

YNAB also offers fantastic customer support, with live chat and email support available if you run into any issues or have questions.

Features of Quicken

Quicken, just like YNAB, is packed with a variety of features that can help you take control of your personal finances. While YNAB focuses more on budgeting, Quicken offers a wide range of tools and capabilities to manage different aspects of your financial life.

One standout feature of Quicken is its investment tracking. If you have stocks, bonds, or other investments, Quicken allows you to track their performance and keep an eye on your portfolio’s value.

This can be particularly useful if you’re looking to optimize your investment strategy and make informed decisions.

Quicken also offers bill payment reminders, which can be a lifesaver for those who struggle with due dates and keeping track of their bills.

You can set up automatic reminders and even schedule payments directly through the software, making it easier to stay on top of your financial obligations.

Additionally, Quicken provides tax planning tools that can be beneficial, especially during tax season. It can help you organize and categorize your expenses, generate reports, and even calculate deductions.

This feature can save you time and effort when it comes to filing your taxes and ensuring you’re maximizing your deductions.

Pricing Comparison

Now let’s talk about the pricing of YNAB and Quicken. This is an important factor to consider when choosing a personal finance software, as you want to make sure you’re getting the most value for your money.

YNAB offers a subscription-based pricing model, which means you pay a monthly or annual fee to access the software. The monthly subscription costs $11.99 per month, while the annual subscription costs $84 per year.

While this may seem a bit pricey compared to other budgeting apps, many users find that the benefits and features of YNAB outweigh the cost. Plus, YNAB often offers free trials and discounts, so keep an eye out for those.

On the other hand, Quicken offers a few different pricing options. They have a Starter edition, which costs $34.99 per year, and it provides basic budgeting and financial tracking features.

They also have a Deluxe edition, which costs $49.99 per year, and it includes more advanced features like investment tracking and bill reminders.

If you need even more features, you can opt for the Premier edition, which costs $74.99 per year and includes additional tools for tax planning.

Ultimately, the pricing decision will depend on your personal financial situation and the features that are most important to you.

YNAB may be worth the investment if you’re serious about getting your finances in order and need a comprehensive budgeting tool. Quicken, on the other hand, offers more options depending on your budget and specific financial needs.

Ease of Use Comparison

Now let’s talk about the ease of use when it comes to YNAB and Quicken. After all, what good is a personal finance software if it’s too complicated to navigate and use effectively?

When it comes to YNAB, one of its strengths is its simplicity. The interface is clean and user-friendly, making it easy to get started and understand how to use the software.

YNAB focuses on the basics of budgeting and keeps things straightforward, which can be a relief for those who find personal finance intimidating.

On the other hand, Quicken offers a more comprehensive set of features, which can make it a bit more complex to navigate. It has a wide range of tools and capabilities, and while this can be beneficial for those with complex financial situations, it may take some time to get used to the interface and all the available options.

That being said, both YNAB and Quicken offer tutorials, guides, and customer support to help you navigate the software. If you’re willing to put in the time to learn the ins and outs of Quicken, it can be a powerful tool. However, if you’re looking for simplicity and ease of use, YNAB may be the better option for you.

Ultimately, the ease of use will depend on your personal preference and comfort level with technology. Take some time to explore both programs and see which one feels more intuitive and user-friendly to you.

After all, the more comfortable you are with the software, the more likely you are to use it consistently and effectively.

Which One Helps You Reach Your Financial Goals?

So, which one is better for helping you reach your financial goals: YNAB or Quicken? Well, the answer to that question ultimately depends on your personal financial situation and goals. Both YNAB and Quicken have their strengths and can be effective tools for managing your money, but it’s important to consider what you need most.

If you’re looking to get control of your spending, create a budget, and get out of debt, YNAB may be the better choice for you. Its focus on budgeting and goal-setting can help you stay on track and make progress towards your financial goals. YNAB’s emphasis on assigning every dollar a job can be a game-changer for those who struggle with overspending.

On the other hand, if you have more complex financial needs, such as managing investments or organizing your taxes, Quicken may be the better option. Its investment tracking and tax planning tools can provide valuable insights and simplify the process of managing your finances.

Personal Experience with YNAB

I’ve had the opportunity to use YNAB (You Need A Budget) for a few months now, and I have to say, it has been a game-changer for me. As someone who has always struggled with overspending and sticking to a budget, YNAB has helped me gain control over my finances like never before.

One of the things I love about YNAB is its approach to budgeting. It really forces you to be intentional with your money and assign every dollar a job. This has made me more mindful of my spending and has helped me prioritize my financial goals. I no longer find myself mindlessly swiping my credit card without considering the consequences.

Setting financial goals with YNAB has also been incredibly motivating for me. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, YNAB helps me stay on track and see my progress. The regular updates and notifications keep me focused and motivated to keep pushing towards my goals.

Another aspect of YNAB that I appreciate is its user-friendly interface. It’s clean, modern, and easy to navigate. I can easily add transactions, track my spending, and see reports of my financial habits. The mobile app is also a great feature, as it allows me to manage my finances on the go.

I have to mention the amazing customer support from YNAB as well. Whenever I have had questions or issues, their live chat and email support have been prompt and helpful. It’s nice to know that I can reach out for assistance if needed.

Overall, my personal experience with YNAB has been extremely positive. It has helped me become more aware of my spending habits, stay on top of my budget, and make better financial decisions. If you’re looking for a budgeting app that will truly transform your finances, I highly recommend giving YNAB a try.

Personal Experience with Quicken

I have had the opportunity to try out Quicken for a few months now, and I have to say, it has been a game-changer for me as well. While YNAB focuses more on budgeting, Quicken offers a comprehensive set of features that have helped me manage all aspects of my personal finances.

One of the features I appreciate most about Quicken is its investment tracking. As someone who has recently started investing, being able to track the performance of my stocks and monitor the value of my portfolio has been invaluable. It has allowed me to make more informed decisions and optimize my investment strategy.

Another standout feature of Quicken is its bill payment reminders. I used to struggle with keeping track of due dates and often ended up paying late fees. With Quicken, I can set up automatic reminders and even schedule payments directly through the software. It has made managing my bills much easier and stress-free.

Additionally, Quicken’s tax planning tools have been incredibly helpful, especially during tax season. I can easily categorize my expenses, generate reports, and even calculate deductions. It has saved me a lot of time and effort when it comes to filing my taxes and ensuring that I’m maximizing my deductions.

Overall, my personal experience with Quicken has been very positive. Its range of features and tools have allowed me to stay on top of my finances, make smarter financial decisions, and simplify tasks like bill payment and tax planning. If you have more complex financial needs and want a comprehensive finance software, I highly recommend giving Quicken a try.

Pros and Cons of Each

Now that we’ve covered the features, pricing, and ease of use of both YNAB and Quicken, let’s discuss the pros and cons of each. Keep in mind that these are my personal opinions based on my experiences with both software programs, and your experience may differ.

Starting with YNAB, one of its major pros is its focus on budgeting. The emphasis on assigning every dollar a job and setting specific financial goals can be incredibly effective in helping you gain control over your spending and reach your financial goals. The user-friendly interface and excellent customer support are also big pluses.

However, YNAB does have some cons. The pricing may be a bit high for some people, especially if you’re on a tight budget. Additionally, the software may not be as comprehensive as Quicken, especially if you have more complex financial needs like managing investments or taxes.

As for Quicken, its biggest pro is its wide range of features. From investment tracking to bill payment reminders to tax planning tools, Quicken offers a comprehensive solution for managing all aspects of your personal finances. The ability to customize and tailor the software to your specific needs is also a major advantage.

On the flip side, Quicken may be overwhelming for some users, especially those who are new to personal finance software. The interface can be a bit complex, and it may take some time to get used to all the available options. Additionally, the pricing can also be a drawback, as the more advanced features come with a higher price tag.

Final Thoughts

In the end, whether you choose YNAB or Quicken, the most important thing is that you are taking steps towards reaching your financial goals. Both software programs offer unique features and benefits that can help you manage your money more effectively.

If you’re someone who struggles with overspending and wants to create a budget and get out of debt, YNAB might be the perfect fit for you.

Its emphasis on assigning every dollar a job and setting specific financial goals can be a game-changer. Plus, the user-friendly interface and excellent customer support make it easy to navigate and get the help you need.

On the other hand, if you have more complex financial needs like managing investments or organizing your taxes, Quicken might be the better choice. Its comprehensive set of features, including investment tracking and tax planning tools, can provide valuable insights and simplify your financial management tasks.

No matter which software you choose, the most important thing is that you take action and start taking control of your finances. By using a budgeting app like YNAB or a comprehensive finance software like Quicken, you are taking a step in the right direction towards reaching your financial goals.

So, don’t wait any longer. Choose the software that aligns best with your needs, set your financial goals, and start taking control of your money today. Your financial future is in your hands, and with the right tools and determination, you can achieve financial success. Good luck on your financial journey!