There are a crazy number of ways to earn passive income in crypto.

From yield farms and liquidity pools to staking rewards and CeFi lending, you could go crazy exploring all the income opportunities online.

However, one revenue stream I’ve gotten interested in recently is creating master nodes.

No, I’m not talking about setting up costly rigs and mining new blocks for Bitcoin!

I’m referring to storing the essential data on various blockchains and collecting sweet returns for providing computing power.

The only problem is, that it’s very challenging for an average Joe to set up a node all by themselves.

If you want exposure to this crucial aspect of blockchain tech, you’ll usually have to enlist the help of a master node provider.

That’s where YieldNodes comes into the picture.

You see, YieldNodes helps depositors “rent” master nodes and share a significant cut of the profit.

Sounds too good to be true?

That’s what I thought, too.

However, as I kept scouring the Internet for negative YieldNodes reviews, I couldn’t find anything substantial.

The more I looked into this node provider, the more impressed I was with this service.

Personally, I feel YieldNodes could be a fantastic way to diversify my crypto portfolio, and I’ve put my money where my mouth is.

That doesn’t mean YieldNodes doesn’t have flaws, nor is this site right for every investor.

However, if you read my YieldNodes review to the end, you should better understand why I’m genuinely excited about this project.

Slow Down Spencer, What Exactly Is YieldNodes?

As I mentioned, YieldNodes helps investors profit from master nodes on various blockchains.

All nodes on a blockchain are important, but master nodes are essential. From managing transactions to storing data, master nodes help decentralized chains function.

Since these nodes are such a big deal, they also get higher rewards from those who stake their crypto on them.

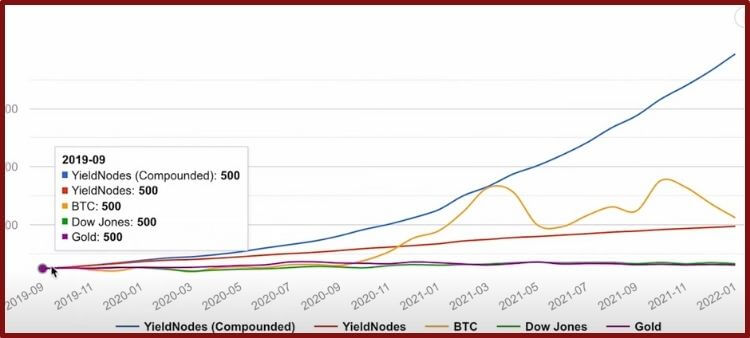

That’s why YieldNodes says it focuses on only renting out master nodes, and that’s why it can post steady returns of roughly 10 percent per month.

And YieldNodes didn’t just come out of the blue with these facts and figures.

This company has been around since 2018 when it started hosting a private master node service.

Although YieldNodes has grown a lot since that time, it remains a relatively small team with four core employees, all of whom are doxxed and based in Hong Kong or Europe:

- Steve H.

- Urs S.

- Yegor V.

- Dima T.

In fact, YieldNodes is so transparent that you could email them directly with questions or hop on a Skype call.

I know because I’ve done it myself!

Wait, I Still Don’t Get It — How Does YieldNodes Work?

I know that renting “master nodes” can be a strange and confusing topic.

To make this concept super simple, I’d suggest thinking about investing in a server for cloud storage.

Blockchain tech needs servers just like Web2 cloud providers use for data storage.

However, since blockchains are decentralized, they have a different incentive system.

In the case of proof-of-stake coins — which is what YieldNodes focuses on — you get rewarded in native tokens for setting up a master node.

The blockchain protocol is literally rewarding you for putting up some risk to secure the network.

While anyone could theoretically create a node, there’s usually a high barrier to entry.

However, since YieldNodes uses deposited funds from thousands of customers, it gives more people access to a proportional share of the rewards.

It’s estimated that YieldNodes takes about 15 percent of the profits from its master node operations, and it distributes the rest to each account holder depending on how much each person puts up.

The exact percentage you’ll receive from YieldNodes fluctuates depending on countless factors.

However, the company has averaged about 10 percent per month.

As a bonus, YieldNodes claims it will refund all of your money if the rewards are below 5 percent for three consecutive months.

If you are interested in YieldNodes, here’s my full tutorial to help you get started:

What Are The Core Features Of Using YieldNodes?

By now, you should have a basic understanding of what YieldNodes has to offer.

To give you a more detailed sense of what to expect with this platform, I’m going to run through a few of the top features you’ll encounter.

Hopefully, this section will give you a preview of what’s available if you decide to open a YieldNodes account.

Master Node Rewards

Obviously, the top reason people get involved with YieldNodes is to rent master nodes and earn passive income.

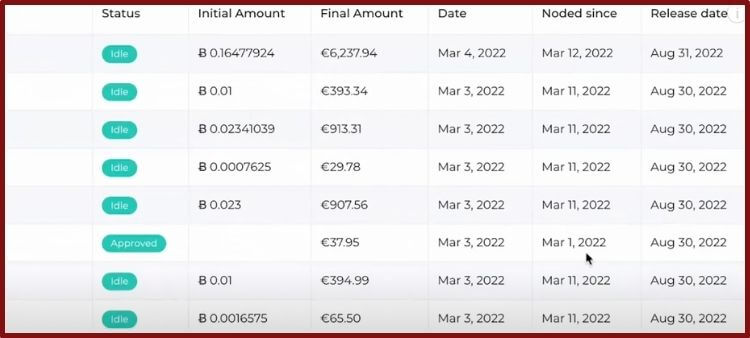

As I’ve discovered from my experience and research, the average range for monthly returns on YieldNodes is between 5 – 15 percent.

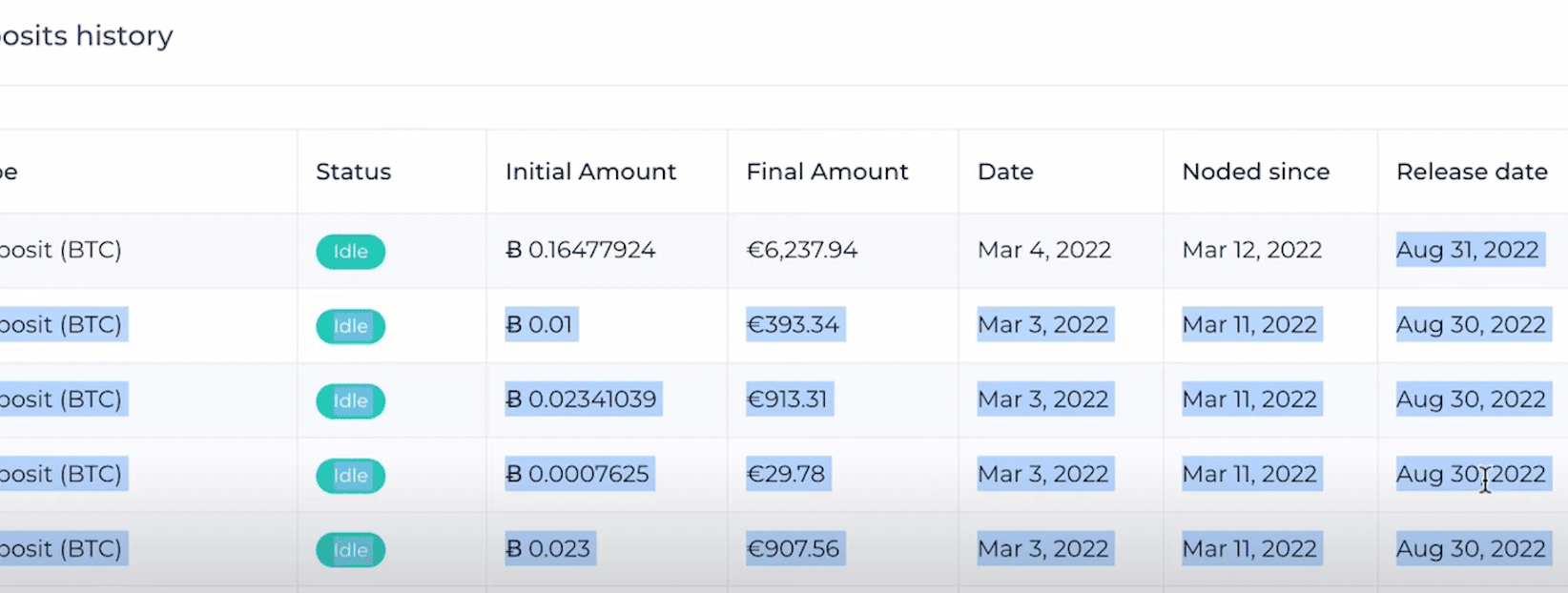

You should see these funds deposited in your YieldNodes account every month.

Speaking of deposits, you could easily send Bitcoin or USDT into your account. There’s also an option to buy crypto directly from YieldNodes with a card if you don’t mind paying extra fees.

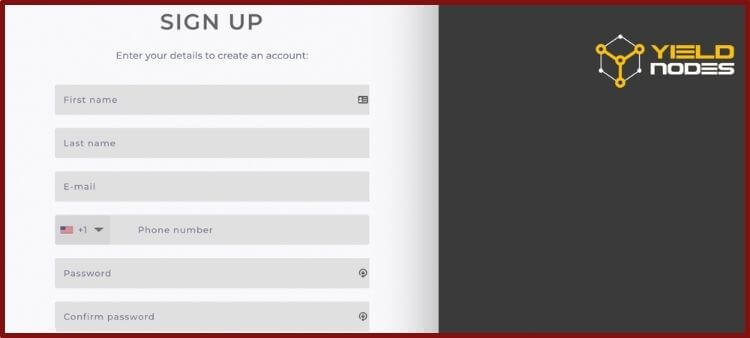

Note: You need to complete KYC registration to access everything on YieldNodes’ site.

Please also be aware you must lock your funds in a YieldNodes account for six months.

Since renting nodes is a costly operation, YieldNodes says it needs the security of a set lockup period.

FYI: The last time I checked, you need to send YieldNodes TRC-20 USDT via the Tron blockchain. If you have zero experience with Tron, please only send Bitcoin to YieldNodes!

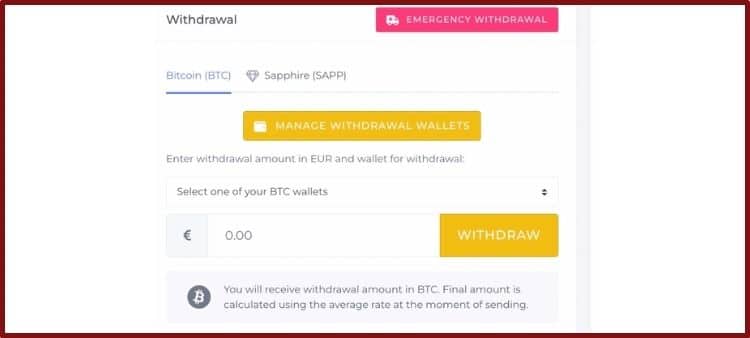

Emergency Withdrawal Option

I know I said you need to lock funds in YieldNodes for six months, but that’s not the whole truth.

You see, YieldNodes gives users the option to pull out funds beforehand with its “Emergency Withdrawal” service.

So, if you were in dire straits and needed the funds right away, you could take advantage of this feature.

However, you’ll pay a hefty fee to release these funds before the lockup period ends.

How much?

25 percent.

To avoid this severe penalty, please plan on keeping any money you choose to put in your YieldNodes locked for six months.

However, I know that sometimes “life happens.”

Just be sure you understand this penalty before exercising the Emergency Withdrawal feature.

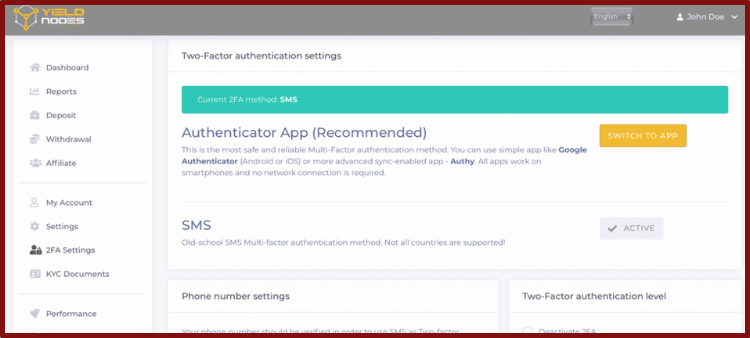

KYC and 2FA Security

Unlike some other node providers, YieldNodes requires KYC info to use its site.

If you’re a total privacy hawk, this may be a deal-breaker.

However, this shouldn’t be a big deal if you don’t mind giving over info like your home address, email, and full name.

Also, YieldNodes offers 2FA security to help secure your account.

I’d strongly recommend using an authenticator app like Authy, Google Authenticator, or Microsoft Authenticator with this function.

Download one of those apps and scan the QR code provided by YieldNodes.

Once your 2FA is set up, you’ll need to enter the associated code to log in to your account.

This standard strategy dramatically reduces the risk of a hack.

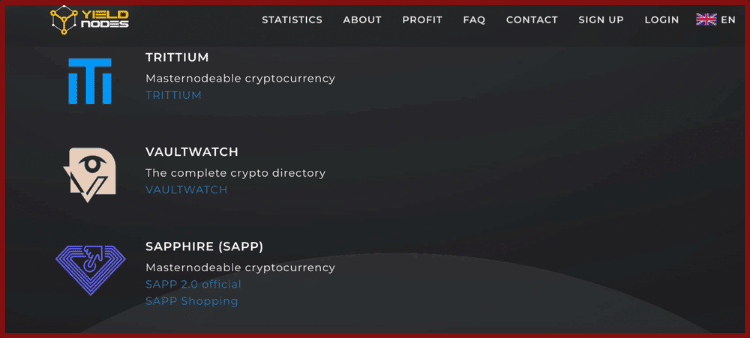

Diversity of Projects

YieldNodes is transparent about all the master node projects they use.

In fact, you could take a look at all their node offerings by scrolling down the home page’s bottom section.

Currently, there are over a dozen projects YieldNodes invests in, which I feel gives them extra security.

If one master node operator goes down for some reason, it’s unlikely all of them will go bust simultaneously.

I’d encourage you to read through each of the node operators in YieldNodes’ list to understand whether you’re comfortable investing in these projects.

Customer-Approved Audits

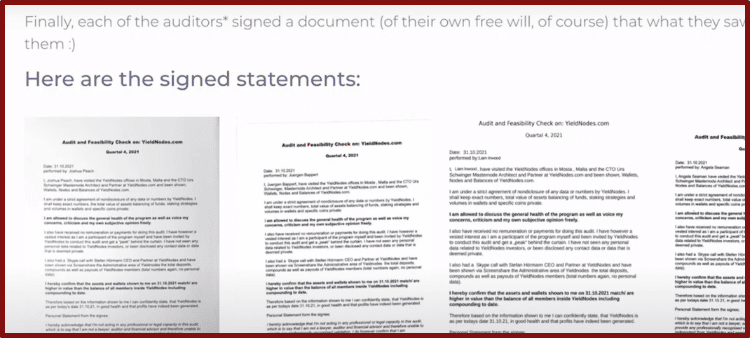

YieldNodes has plenty of audits on its website, but they’re super unorthodox.

What do I mean?

Well, instead of bringing in a professional auditor like Deloitte, YieldNodes paid to bring a few verified users to check out their operations.

Yes, YieldNodes’ team flew a bunch of average investors to check out how they run the business.

After the audit was complete, each person signed their statements.

You can read all of these reports on YieldNodes’ website.

OK, I know what a few readers may be thinking: “How are random YieldNodes’ users supposed to know how to audit a company?”

That’s a valid question.

Although all of these audits appear to be legit, you’re just going to have to trust the company on this move.

I’m not a professional auditor, so I can’t verify all the claims made in these reports.

All I can say is, I will take YieldNodes up on its offer to check out the company!

Hopefully, if I can become an “amateur auditor” in the future, I’ll have more to say about this feature.

Until then, I’d encourage anyone new to YieldNodes to take a few moments to read the signed reviews on their website.

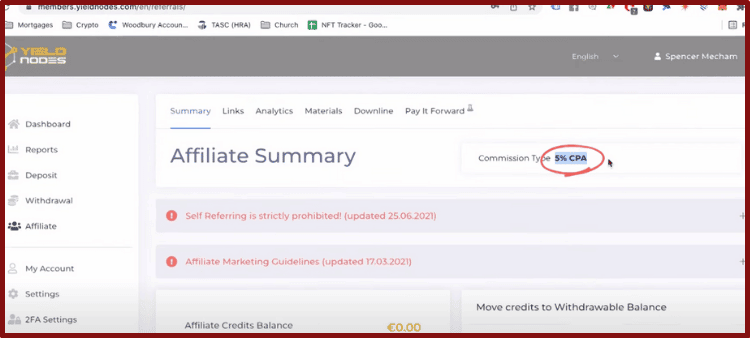

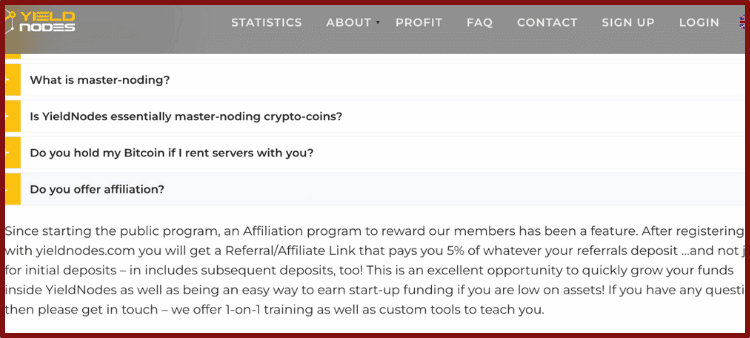

Affiliate Program

Even though YieldNodes has an affiliate program, it’s easy to miss it.

Unlike other node providers, YieldNodes doesn’t push its affiliation opportunities in its advertising.

Personally, I found it rather refreshing that YieldNodes didn’t focus a ton of attention on this feature.

After all, the reason someone should sign up for YieldNodes is for renting master nodes, not onboarding a bunch of people into a Ponzi scheme!

That being said, YieldNodes has a generous referral rewards program users could take advantage of.

Whenever someone deposits crypto using your referral link, you will get a 5 percent cut of whatever they put into their account.

Impressively, YieldNodes says this 5 percent kickback isn’t just a one-off reward.

Every time your referral customer puts money into YieldNodes, you’ll still get 5 percent back!

Full disclosure: I have an affiliate link for YieldNodes.

However, I swear using this perk isn’t the primary reason I signed up for YieldNodes, nor does it significantly sway my YieldNodes review.

It’s just a nice bonus to know this affiliate program exists.

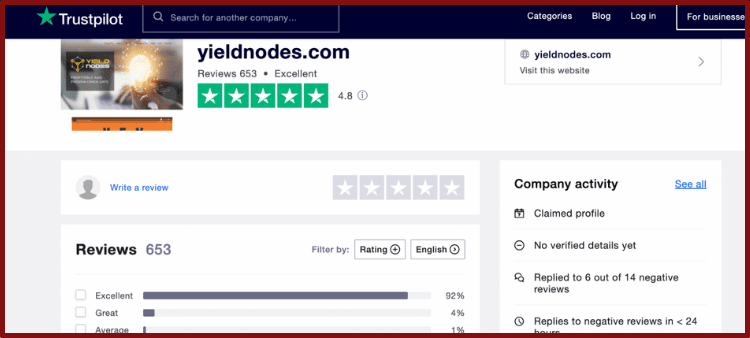

What Are Other Reviewers Saying About YieldNodes?

When I first stumbled across YieldNodes, I instantly thought it was too good to be true.

How could a company consistently promise ~ 10 percent per month?

This has to be some kind of Ponzi, right?

However, as I went down the rabbit hole researching YieldNodes reviews, I couldn’t find anyone talking smack about this company.

Take a peek at TrustPilot, for Pete’s sake!

Big brands like Coinbase get demolished on TrustPilot, but YieldNodes comes out squeaky clean.

I also didn’t see any prominent YouTuber or Reddit thread that seriously called YieldNodes into question.

While a few people had some minor issues with YieldNodes’ UI, slow deposit system, or lack of a “true” audit, nobody seems to have had a problem getting the advertised interest rate.

Also, everyone who has questions about YieldNodes’ services says they didn’t have an issue reaching out to its staff.

As I already mentioned, I can vouch for YieldNodes’ swift customer response.

If you still feel like YieldNodes is “too good to be true,” I’d recommend speaking directly to the company’s leadership.

Under YieldNodes’ “Contact Us” tab, you’ll find plenty of ways to get your questions answered.

Are There Any YieldNodes Alternatives?

If you don’t feel comfortable with YieldNodes, then there are plenty of alternative node projects you could get involved with.

However, most other big-name node providers require you to buy their altcoin and either stake it or burn it.

This is why I found YieldNodes to be a unique service.

On YieldNodes, you should expect a steady return of 10 percent regardless of the crypto market.

Of course, you could make way more money if you pick the right master node provider, but there’s also a higher chance you’ll get rekt.

It all depends on your risk preferences.

Here are a few hot node operators in the crypto industry to get you started.

StrongBlock

StrongBlock is one of the more popular node providers running on Ethereum and Polygon.

Created by David Moss of EOSIO fame, StrongBlock offers users an intuitive interface to create a node with its STRONG token.

Although StrongBlock claims to be operating ~ 500,000 nodes, please keep in mind that the STRONG token is incredibly volatile.

Recently, STRONG has taken a massive nosedive with the overall crypto market crash.

So, even if you were earning “great” rewards with StrongBlock, you have to feel confident the STRONG token will increase in value.

I’d also encourage new investors to first hop on StrongBlock’s Discord and watch David Moss’s AMAs.

VaporNodes

VaporNodes hasn’t been around as long as StrongBlock, but it has built a significant following with AVAX fans.

According to VaporNodes’ site, it runs its nodes on the Avalanche blockchain to take advantage of lower fees.

While Avalanche isn’t as big as Ethereum, it remains solidly in the top 20 crypto projects.

Remember that you’ll have to buy and use VaporNodes’ crypto VPND.

I’d only recommend this project to people familiar with Avalanche and who believe in the project.

The barrier to entry into VaporNodes is pretty low, but please take a peek at the company’s Discord before jumping into this site.

So, Do You Agree With My YieldNodes Review?

“Nodes” has become a notorious term in recent crypto investing.

Unfortunately, there are a lot unprofitable projects vying for your money.

However, your research could pay off if you find one node provider that can provide solid passive income.

For my money (literally!), I feel YieldNodes offers the highest risk-to-reward ratio.

This team has a record of delivering ~ 10 percent per month, and you don’t have to worry about the volatility of buying into a new altcoin.

However, I know investing in YieldNodes won’t appeal to everyone. There are significant risks involved in buying into these projects, and I’m not a financial advisor.

If you’re concerned about using YieldNodes, I’d recommend watching my full video review.

You could also reach out to the team directly with specific questions.

Please never rush into making a significant investment decision, and never send more crypto than you’re willing to lose.