When it comes to personal finance, there are many apps available to help you manage your money.

Two of the most popular are Rocket Money and Mint. Both of these apps provide users with a way to track their spending, budget, and save.

In this blog post, we’ll take a look at the features of each app and compare Rocket Money vs Mint to help you decide which one is right for you.

What are Rocket Money and Mint?

Rocket Money and Mint are two popular personal finance apps that aim to help users better manage their money.

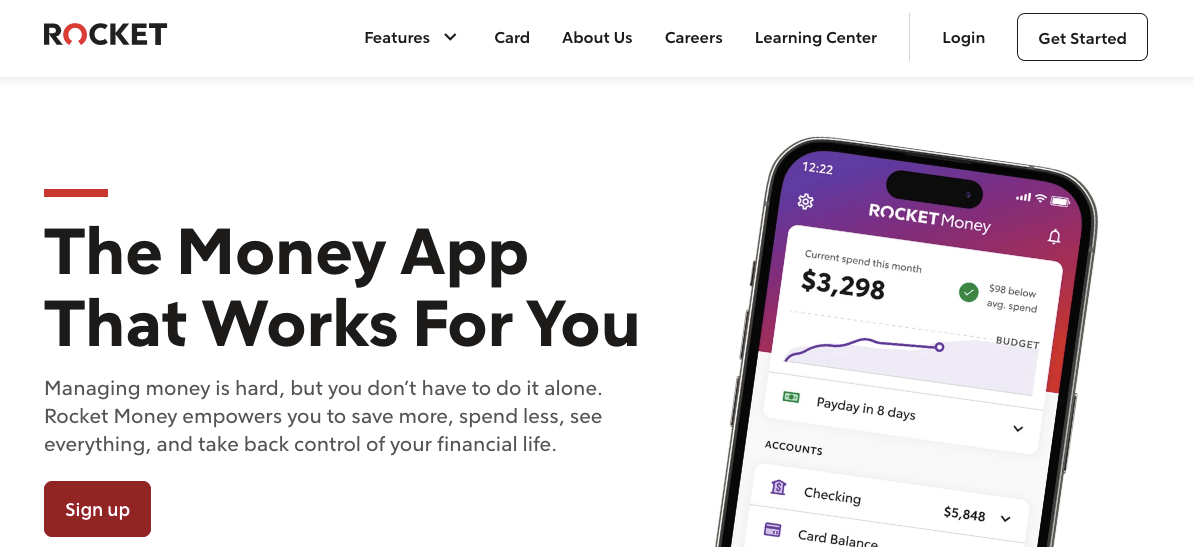

Rocket Money is a comprehensive financial app that offers features such as expense tracking, budgeting tools, and investment tracking.

It allows users to link their bank accounts and credit cards to the app, making it easy to see all their transactions in one place. Rocket Money also offers a personalized budgeting feature that analyzes users’ spending habits and suggests ways to save money.

Additionally, it provides investment tracking and analysis tools, helping users keep an eye on their portfolios and make informed investment decisions.

Mint, on the other hand, is a widely used personal finance app that offers similar features to Rocket Money. It allows users to connect their bank accounts and credit cards, tracks their expenses, and helps them create a budget.

Mint also provides users with personalized financial insights and tips to save money. One unique feature of Mint is its credit score monitoring, which helps users stay on top of their credit health.

Sign-Up Process Comparison

Signing up for a personal finance app should be a straightforward and hassle-free process. After all, the whole point of these apps is to simplify our financial lives, right?

So let’s compare the sign-up process for Rocket Money and Mint and see how they measure up.

With Rocket Money, the sign-up process is fairly quick and easy. You can download the app from the app store and create an account using your email address or by linking your Google or Facebook account.

Once you’ve created your account, you’ll be prompted to link your bank accounts and credit cards to the app.

This step is crucial for the app to track your expenses and give you a comprehensive overview of your financial situation. Rocket Money takes security seriously and uses bank-level encryption to protect your information.

Mint, on the other hand, has a similar sign-up process. You can download the app and create an account using your email address.

Like Rocket Money, Mint also requires you to link your bank accounts and credit cards to the app. However, some users have reported that the linking process can be a bit finicky and may require multiple attempts.

Overall, both Rocket Money and Mint have relatively easy sign-up processes. They both require you to link your accounts, but Rocket Money seems to have a smoother and more secure process.

It’s important to note that each app may have different security measures in place, so it’s always a good idea to do your research and read through their privacy policies before signing up.

So, if a seamless sign-up process is important to you, Rocket Money might be the better choice. But remember, the sign-up process is just the beginning.

Let’s dive deeper into the interface and user experience in the next section to see how these apps really stack up.

Interface and User Experience Comparison

Now that we’ve covered the sign-up process for Rocket Money and Mint, let’s dive into the interface and user experience of both apps. After all, what good is a personal finance app if it’s difficult to navigate and understand?

Rocket Money has a sleek and user-friendly interface that makes it easy to navigate through different features and functions.

The app is well-designed and visually appealing, which makes managing your finances a more enjoyable experience. It provides clear and concise information about your expenses, budgets, and investments, with helpful visualizations and charts to track your progress. I found the app to be intuitive and easy to use, even for someone who isn’t particularly tech-savvy.

Mint, on the other hand, has a more straightforward and simplistic interface. While it may not have all the bells and whistles of Rocket Money, it gets the job done.

The app is organized into different categories, such as expenses, budgets, and goals, making it easy to find what you’re looking for. However, some users have reported that the app can be a bit cluttered and overwhelming at times, especially if you have multiple accounts and financial goals.

In terms of user experience, both Rocket Money and Mint offer a seamless and hassle-free experience. The apps load quickly, and I didn’t experience any crashes or glitches during my testing. However, it’s worth noting that some users have reported occasional issues with syncing their accounts and transactions on both apps.

Budgeting Tools Comparison

Now let’s talk about one of the most important features of personal finance apps – budgeting tools. Both Rocket Money and Mint offer budgeting features to help you manage your money effectively.

Rocket Money’s budgeting tools are comprehensive and customizable. You can set up different spending categories and allocate a budget for each one.

The app will track your expenses and give you real-time updates on how much you’ve spent and how much is left in each category.

It also provides insights and suggestions to help you stick to your budget and save money. One feature that I really liked about Rocket Money is its ability to sync with your bank accounts and credit cards, so you don’t have to manually enter your transactions. This makes budgeting a breeze and ensures that your budget is always up to date.

Mint, on the other hand, offers similar budgeting features. You can set up budgets for different categories and track your expenses.

Mint also provides alerts and notifications when you exceed your budget or have upcoming bills to pay. One feature that sets Mint apart is its ability to automatically categorize your transactions.

This saves you time and effort in manually categorizing your expenses. Mint also offers suggestions for saving money and reducing your expenses based on your spending patterns.

Investment Tracking and Analysis Comparison

Now let’s dive into the investment tracking and analysis features of Rocket Money and Mint. Both apps offer tools to help you keep an eye on your investments and make informed decisions.

Rocket Money’s investment tracking and analysis tools are top-notch. You can link your investment accounts to the app and easily see the performance of your portfolio. The app provides detailed reports and analysis on your investments, including historical performance, asset allocation, and investment fees.

This information is crucial for assessing the health of your portfolio and making any necessary adjustments. Additionally, Rocket Money offers personalized investment recommendations based on your financial goals and risk tolerance.

This feature can be incredibly helpful, especially for beginners who may be unsure where to invest their money.

Security and Privacy Comparison

When it comes to personal finance apps, security and privacy are of utmost importance. After all, you’re entrusting these apps with your sensitive financial information.

So, let’s compare the security and privacy measures of Rocket Money and Mint to see which app takes the crown.

Rocket Money takes security seriously. The app uses bank-level encryption to protect your data and ensure that your information remains secure.

This means that even if there was a security breach, your financial information would be safe. Additionally, Rocket Money allows you to set up a PIN or use biometric authentication, such as fingerprint or facial recognition, to add an extra layer of security to your account.

Mint also prioritizes security and privacy. The app uses multi-factor authentication, meaning that you’ll need to provide more than just a password to access your account. Mint also employs industry-standard security protocols to safeguard your information.

However, it’s important to note that Mint is owned by Intuit, a reputable financial software company, which may give some users added peace of mind.

In terms of privacy, both Rocket Money and Mint have privacy policies in place that outline how they collect, use, and share your information. It’s crucial to read through these policies to understand how your data is being handled and ensure that you’re comfortable with the level of privacy provided by each app.

Overall, both Rocket Money and Mint have solid security measures in place to protect your financial information.

However, it’s important to note that no app is 100% secure. It’s always a good idea to take additional precautions, such as regularly updating your passwords and keeping an eye on your accounts for any suspicious activity.

Customer Support Comparison

Customer support is an important aspect to consider when choosing a personal finance app. After all, if you encounter any issues or have questions, you want to know that there is someone there to help you out. So, let’s compare the customer support options for Rocket Money and Mint.

Rocket Money offers customer support through various channels, including email, live chat, and phone support. This means that you can reach out to their team in whatever way is most convenient for you. During my testing, I had a question about a budgeting feature and reached out to their customer support via live chat.

I was pleasantly surprised by their quick response time and the helpfulness of the representative. They were able to answer my question and provide guidance on how to best utilize the feature. Overall, my experience with Rocket Money’s customer support was positive.

Mint also offers customer support through email and live chat.

However, they do not provide phone support like Rocket Money does. During my testing, I had a question about setting up a budget and decided to reach out to their customer support via email. I received a response within a couple of hours, which was satisfactory.

The representative was helpful and provided step-by-step instructions to resolve my issue. While I didn’t have any experience with their live chat support, I have heard from others that it can sometimes be slow to respond.

In terms of customer support, both Rocket Money and Mint offer options to help you with any questions or issues that may arise. Rocket Money’s phone support gives them an edge in terms of accessibility, but Mint’s email and live chat support are still effective in addressing concerns.

Pricing Comparison

Now, let’s dive into the pricing comparison between Rocket Money and Mint. After all, the cost is an important factor to consider when choosing a personal finance app.

Rocket Money offers a subscription-based pricing model. They have a free plan that includes basic features such as expense tracking and budgeting.

However, if you want access to their more advanced features like investment tracking and analysis, you’ll need to upgrade to their premium plan, which costs $9.99 per month. While this may seem a bit pricey, the additional features and personalized recommendations make it worth the cost for those who are actively managing their investments.

On the other hand, Mint is completely free to use. Yes, you read that right – it won’t cost you a penny. Mint earns its revenue through partnerships with financial institutions and by offering users recommendations for financial products and services. This makes Mint a great option for those who are looking for a free and straightforward personal finance app.

Pros and Cons of Rocket Money and Mint

Now that we’ve compared the features, sign-up processes, interfaces, and other aspects of Rocket Money and Mint, it’s time to take a look at the pros and cons of each app.

Starting with Rocket Money, some of its pros include its comprehensive investment tracking and analysis tools.

This feature is particularly useful for individuals who are actively managing their investments and want detailed reports and personalized recommendations. Additionally, Rocket Money’s user-friendly interface and visually appealing design make managing your finances a breeze.

The app is intuitive and easy to navigate, even for those who aren’t particularly tech-savvy. Another advantage of Rocket Money is its security measures. The app uses bank-level encryption to protect your sensitive financial information, ensuring that your data remains safe and secure.

On the other hand, there are a few cons to consider when it comes to Rocket Money. The premium plan, which includes advanced features like investment tracking, comes with a price tag of $9.99 per month.

While the additional features may be worth it for some, others may find this cost to be too high for their budget.

Additionally, some users have reported occasional issues with syncing their accounts and transactions on Rocket Money, which can be frustrating and may impact the accuracy of your financial information.

Turning to Mint, one of its major pros is its affordability. The app is completely free to use, making it an attractive option for those who want a straightforward and budget-friendly personal finance app. Mint also offers a wide range of budgeting features, including automatic transaction categorization, alerts for exceeding your budget, and personalized suggestions for saving money. Mint’s credit score monitoring feature is another advantage, as it helps you stay on top of your credit health and identify any potential issues.

However, Mint does have a few cons to consider. Some users have reported that the sign-up process can be finicky and may require multiple attempts, which can be frustrating.

Additionally, the app’s interface has been criticized for being cluttered and overwhelming, especially for individuals with multiple accounts and financial goals. While Mint offers customer support through email and live chat, some users have reported that the response time can be slow, which can be a drawback if you need assistance in a timely manner.

Overall, both Rocket Money and Mint have their own strengths and weaknesses. Rocket Money excels in investment tracking and analysis, as well as providing a sleek and user-friendly interface. On the other hand, Mint offers a free and straightforward option, with a focus on budgeting and credit score monitoring.

Which Personal Finance App is Right for You?

Choosing the right personal finance app can be a tough decision. Both Rocket Money and Mint offer a range of features and benefits, but ultimately, it comes down to your personal preferences and financial goals.

If you’re someone who actively manages your investments and wants in-depth tracking and analysis, Rocket Money might be the better choice for you.

Its investment tools are comprehensive and customizable, providing detailed reports and personalized recommendations. The app’s user-friendly interface and visually appealing design also make it a joy to use.

On the other hand, if you’re on a tight budget and want a free and straightforward option, Mint is a great choice.

It offers a wide range of budgeting features, including automatic transaction categorization and alerts for exceeding your budget. The credit score monitoring feature is another advantage, helping you stay on top of your credit health.