WHAT IS SHORT SELLING

When a new investor first thinks of the stock market they think in traditional terms of buy low, sell high. You purchase shares of stock and expect them to go up, then you sell them once that occurs.

What if you are much more positive that a stock’s price is going to lose value?

Shorting a stock is a way to make money off of a stock price decrease. This means that you can make money no matter which direction a particular stock, or the entire market is headed.

Shorting is healthy for a market to keep prices balanced and from getting overvalued.

Behind the Scenes

While shorting a stock is easy, depending on which broker you use, the behind the scenes is a little more complicated. Here are the steps that occur.

- Investor Bob shorts stock A in platform

- Broker finds shares of stock A currently owned by other investors (Investor Jon) via that broker

- Broker sells Investor Jon’s shares of Stock A

- At this point Investor Bob (the short seller with a short position) owes Investor Jon the number of shares he chose to short. Investor Bob hopes that the price of the stock will go down so that he can buy back the shares at a lower price and return his debt to Investor Jon. He can then pocket the difference.

- Once Investor Bob is ready, he closes his short position by buying back the the shares that he owes to Investor Jon. If the stock went down, he made money. If the stock went up, he lost money because he had to buy back the shares he owed at a higher price then when he short sold them.

WHY SHORT STOCK?

There are multiple reasons a trader might want to short a stock. Here are the main ones.

Overvalued

The top reason to short stocks is the belief that they are overvalued. An investor may feel that they know something that the rest of the public doesn’t.

Or perhaps they just believe that the price of the stock has been driven up artificially and is on the verge of a collapse.

Hedging

One reason many investors will short stocks is to do what is called hedging. Hedging is where you try to insure yourself against a price drop or price increase. Usually this means offsetting one part of your stock portfolio with a purchase that tends to do the opposite.

For example, gold stocks tend to go up when the rest of the market goes down. This is because investors tend to purchase gold stocks as markets get tumultuous. Gold becomes undersupplied and overdemanded and the price rises to find equilibrium.

So investors that are long on the markets (meaning you expect the general market prices to rise), might hedge themselves with gold.

If they own both gold stocks, and regular market funds like the S&P 500, then when the market crashes, their gold stocks go up and their portfolio doesn’t take as big of a beating.

Taxes

Investors that use tricks to decrease taxes can literally double their retirements portfolios over time.

If you are just starting out you have likely not seen the effect that taxes can have on profits. Simply put, you do not have to pay taxes on profits until you sell shares of stock.

“If you have had a good year, and don’t want to sell shares because of taxes, but also don’t trust the current state of markets, you can short the same stock and same number of shares.”

This will in effect freeze your earnings for that particular stock where they are. If the stock goes up 5%, you make 5% with your long position and lose 5% with your short position.

If the stock drops 5%, you lose 5% on your short position and make 5% on your long position. Both ways come out to 0% gains or losses.

HOW TO SHORT SHARES OF STOCK

Shorting a stock is just as easy as buying a stock. As shown in the diagram below (using TD Ameritrade), you simply click sell, then select the “sell short” option. If there are investors with shares for your broker to borrow, the sell will go through.

Please note that brokers require a margin account in order to short sell shares of stock. This is because margin accounts are for borrowing, and you are borrowing another investor’s shares when you open a short position.

When you are ready to close your short position simply buy back the shares you sold by clicking “buy to cover” as your purchasing option.

Note that you can only short sell stock that the broker has available. If they don’t have any shares for you to short, it won’t work.

MAKING MONEY SHORT STOCKS

There are a couple ways you can make money shorting stocks including the following.

Takeover Play

Often a stock price will spike when rumors of a company takeover occur. A company takeover is when one company offers to buyout another at a set price per share.

Typically the buyout will occur at a higher price per share than the current price, so when rumors of a buyout occur the price climbs quickly as investor try to get in before the announcement.

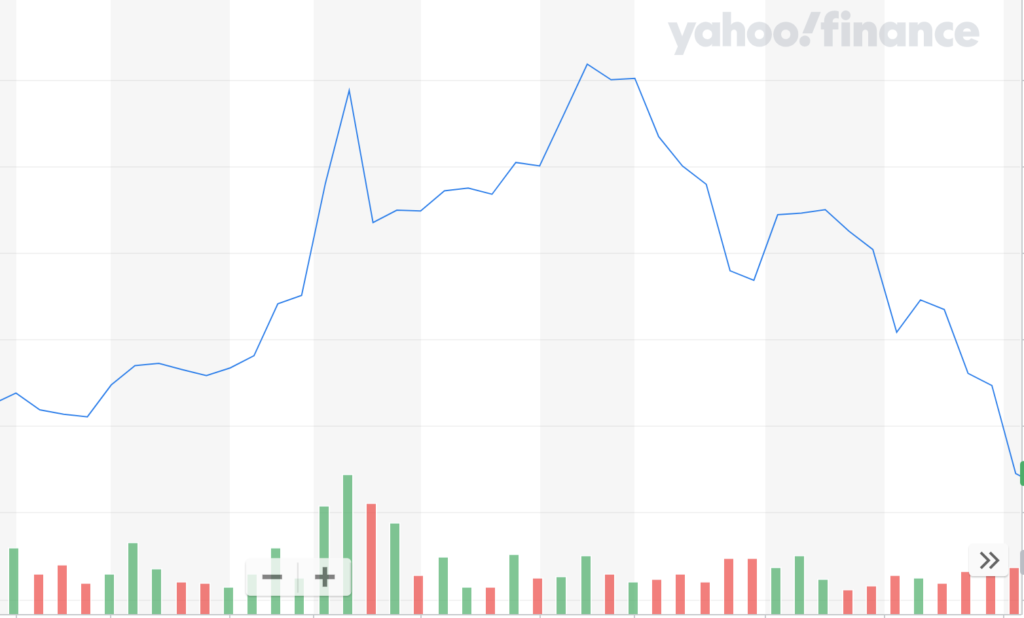

However, oftentimes it will turn out to just be a rumor. Once it is a confirmed rumor the price of the stock will drop back down to previous levels. This prevents a great opportunity to short stocks in this situation.

Simply watch closely for the news, and the instant it is announced short the stock. It will typically drop for a few hours or days after the news.

Earnings

As discussed in our lesson on earnings, earnings announcements can be accompanied by abrupt rise and falls in stock price. If earnings are bad, there is a good chance the stock price will drop for a few days.

Many investors know how to short right after the announcement and hold for just a few minutes during the initial drop, then sell, having only shorted shares of stock for a few minutes.

Unsuccessful Products

Sometimes companies will product a lot of hype about a new product, only to release a disappointment. Apple, for example, will sometimes release a new phone only to discover a significant bug days after release.

These bugs and product flops can provide a great opportunity to short the stock. A good way to find stocks to short using this method would just be to use recently released products.

If the software is buggy for you, it probably is for others as well, and it will eventually come out.

TIPS AND POINTERS FOR SHORTING

To avoid losing everything you own shorting stocks read these tips.

Unlimited Losses

When you buy shares of stock you are only risking the money you put in. Your maximum loss is just the amount that you invested.

When you short stock, however, you have the potential for unlimited losses. Here is the math.

Let’s say you short 10 shares Stock A at $10 a share. Six months letter Stock A has tripled in value and is now worth $30. You are forced to buy back the shares at $30 a share for a total of $300.

You have lost $200, even thought you only technically invested (via shorting) $100.

Margin Call

Sometimes your broker will force you to cover your short position if it looks like your losses are getting too big. They will issue a margin call, giving you a few days to put more money in your account.

If you do not deposit cash they will cover your short position for you at whatever the current price of the stock is. This can lead to catastrophic losses, but the broker needs to protect itself.

Short Squeeze

When a stock that is heavily shorted suddenly climbs in price, a lot of margin calls can be issued.

When a large number of investors are forced to cover their short positions then a lot of buy orders will force the price of thee stock even higher.

This will cause even more margin calls, forcing the price higher again, and so on and so forth. Being short a stock during a short squeeze is not a good feeling and can lead to excessive losses.