In terms of daily trading volume, Binance is a Bitcoin beast.

Or should I say the Bitcoin beast!

Unless Binance makes a big blunder in the upcoming years, it’s unlikely another crypto exchange will reach its enviable top position.

However, that doesn’t mean Binance has a stranglehold on crypto trading.

Sure, many traders love using Binance, but some might not enjoy this site.

Heck, many people still can’t access Binance’s crypto trading services.

In fact, for many American hodlers, Gemini may be the better crypto exchange.

No question, it’s way easier for Americans to sign up for a Gemini account.

But does that mean Gemini is the “better” option in the USA?

After all, most Americans could still use Binance.us.

If you’re torn between these two top crypto exchanges, then this is the blog for you.

Below, I’ll share who I think is the ideal crypto investor for Gemini vs. Binance.

Gemini vs. Binance — Which Crypto Exchange Comes Out On Top?

Availability

Binance may be available in over 500 countries, but that doesn’t mean a heck of a lot to US residents.

Unfortunately for Americans, it’s impossible to set up a Binance account.

If you try to visit Binance’s homepage in the USA, it’ll redirect you to Binance.us.

OK, so what the heck is “Binance.us?”

Basically, Binance.us is a more heavily regulated version of Binance.

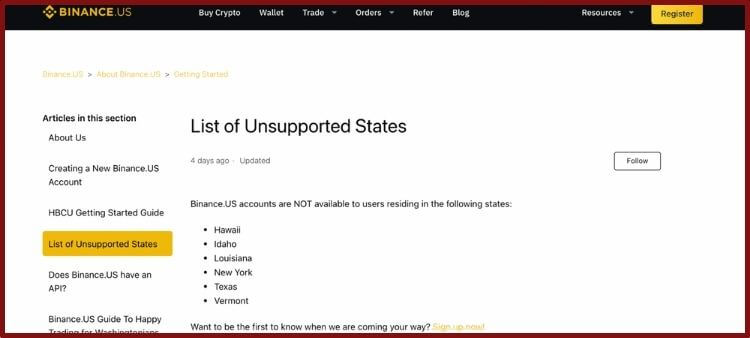

Although Binance.us is available in most US territories, there are a few states where you can’t access it.

By contrast, Gemini is one of the few centralized exchanges available in all 50 states.

When the Winklevoss twins founded Gemini, they made it their mission to comply with every crypto restriction in every US state.

Therefore, everyone in North America can access Gemini.

Plus, Gemini doesn’t face the same regulatory scrutiny as Binance does.

Not only is Gemini based in New York, it’s super committed to compliance.

Conversely, Gemini’s commitment to regulation means it’s not as widespread in non-US countries.

Currently, you could use a Gemini account in about 60 countries.

While Binance is technically “more available” worldwide, Gemini is easier to access in the USA.

So, if you’re a US resident, Gemini is the clear winner in this category.

However, anyone outside the USA probably has a better shot signing up on Binance.

Winner: Gemini for US residents; Binance for non-US citizens.

Ease of Set-Up

Since Gemini has such a high reputation for compliance, you might assume it’s easier to set up a Binance account.

However, the sign-up process for Gemini, Binance, and Binance.us is remarkably similar.

After entering your email and password, you’ll have to verify your identity with standard KYC info.

For instance, you’ll need to share your name, telephone number, and a government-issued photo ID.

Once Binance or Gemini verifies your identity, you could link your bank account for ACH or wire transfers.

You could also link a debit card to either exchange, but you will pay higher fees for this feature.

Honestly, it shouldn’t take more than a few minutes to register on either of these platforms.

Winner: Draw

Security

Security is a top concern at Binance and Gemini…as it should be!

When using a centralized exchange, you need to know your crypto provider has your back.

Yet again, Gemini and Binance use similar safety strategies to protect their users’ funds.

For instance, both exchanges use cold storage to hold most of their digital assets.

Customers could use extra security features like address whitelisting, biometric log-in, and 2FA.

American users also enjoy FDIC insurance on USD when using Binance.us and Gemini.

As for stolen crypto, Gemini offers reimbursement on lost funds in its hot wallet.

Binance also has a reserve called the “SAFU Fund” to cover cyber attacks.

In fact, Binance had to dip into SAFU in 2019 after hackers stole roughly 7,000 Bitcoins from users’ accounts.

Binance claims it has reimbursed everyone affected by this attack.

Although Binance has excellent security standards, I think Gemini has a slight edge in this category.

For starters, Gemini has yet to experience a hack.

Also, Binance faces increased scrutiny in countries like the US and UK.

In my opinion, there’s a higher risk government would ban Binance versus Gemini.

Not only does Binance have an unknown headquarters, but its BNB token could also be viewed as a “security.”

For more details on how the US SEC could shut down crypto projects, be sure to read my post on “Buying XRP on PayPal.”

There’s also a lot of chatter nowadays about DeFi regulation.

Since Binance operates the Binance Smart Chain, it could draw the ire of lawmakers in the ensuing years.

Again, I’m only speculating here.

Overall, I think both of these exchanges have great security standards.

However, if you use Binance, there are a few extra concerns worth considering.

Winner: Gemini

Ease of Use

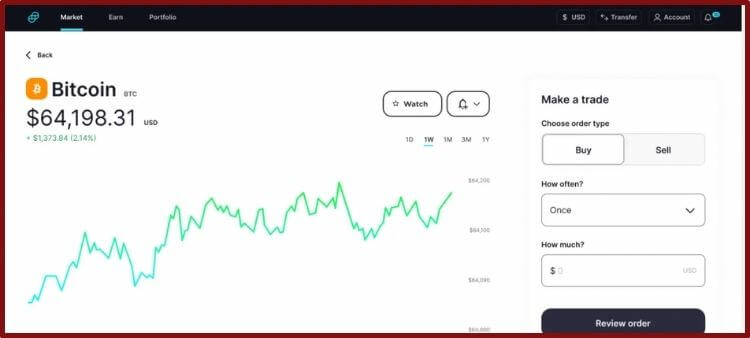

Compared with Binance, Gemini is a breeze to use.

Even if you have zero investing experience, it’s easy to buy or sell a token on Gemini’s website or mobile app.

Simply click “Buy” or “Sell” by the token you’re interested in on Gemini’s main page.

You could also deposit or withdraw funds from your bank by clicking the “Transfer” button on the top right.

Binance, however, has a more “trader-friendly” interface.

In other words, Binance isn’t beginner-friendly.

If you’re not used to terms like “limit order” or “candlestick chart,” then it’s going to take some time to adjust to Binance’s UI.

Unfortunately for newcomers, it’s not as intuitive to trade on Binance.

However, once you get a feel for trading on Binance, you’ll probably enjoy the extra features it offers.

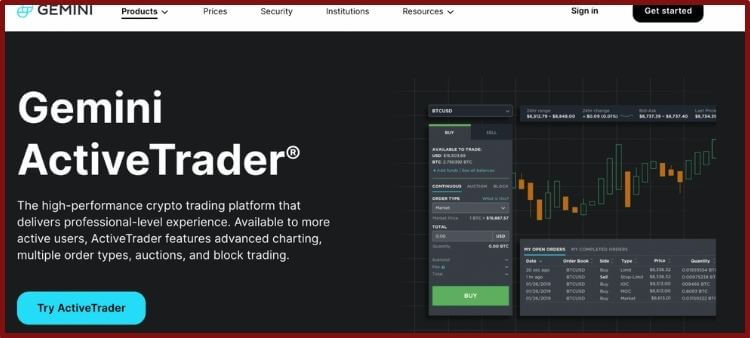

Just keep in mind that you could get a “Binance-like” experience on Gemini.

If you switch on the “Gemini ActiveTrader” function, you will see chart patterns that are remarkably similar to Binance’s interface.

Bonus tip: You’ll also save trading fees on Gemini ActiveTrader.

So, when it comes to UI, you’ve got to go with Gemini!

Winner: Gemini

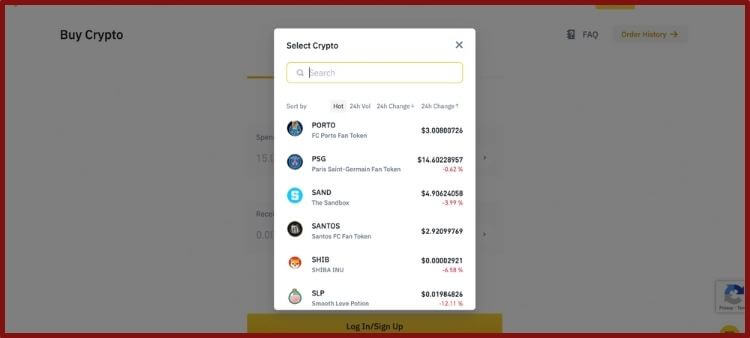

Access to Cryptocurrencies

If you can’t find a token on Binance, you probably won’t find it on another centralized exchange.

Unlike Gemini, Binance isn’t as picky about which coins it lists.

Amazingly, current estimates suggest Binance now has 500 cryptocurrencies on its platform.

Gemini has about 40 large to mid-cap cryptos.

So, if you want to grab a bag of microcap coins, Binance is the better bet.

Please remember that Binance.us doesn’t offer all 500 coins on Binance.

Since Binance.us is tightly regulated, it only has about 50 tokens to choose from.

Still, it’s more likely altcoin hunters will prefer a Binance account.

Winner: Binance

Customer Service

Customer service is a weak point for all crypto exchanges.

Since this industry is so new, it doesn’t have robust customer care standards.

Currently, the only way you could contact Binance or Gemini is via email.

And then you’ve got to wait.

And wait some more.

In Gemini’s case, the company claims to resolve all tickets within one business day.

However, I don’t have personal experience with Gemini’s customer care division.

On the other hand, I know Binance can take way longer than one day to resolve an issue.

For more details on my experience with Binance’s customer care, check out my blog on “KuCoin vs. Binance.”

According to Trustpilot, people have similarly negative experiences with Gemini and Binance’s slow customer care.

So, I don’t think either exchange has an “edge” in this category.

Honestly, Kraken is the only centralized exchange with a high reputation for customer care.

To my knowledge, Kraken is the only exchange that offers live phone support and 24/7 chat.

If you crave premier customer care, I’d recommend learning more about Kraken’s offerings in my post “Kraken vs. Binance.”

Winner: Draw

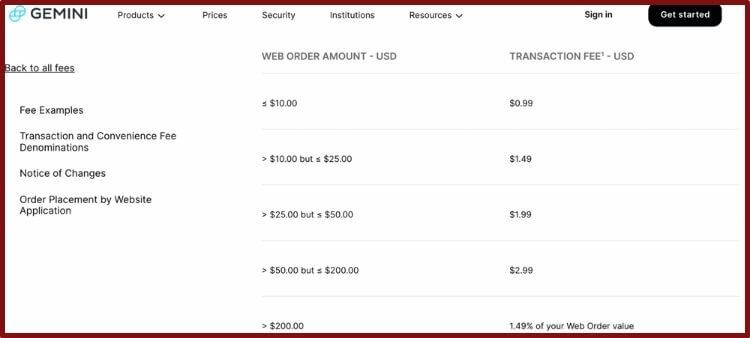

Trading Fees

Let’s be blunt: Most people love Binance because it’s cheap to trade on.

How cheap?

According to Binance.us’s fee structure, you’ll pay a 0.1 percent maker or taker fee for crypto purchases under $50,000.

By comparison, it costs 1.49 percent to buy over $200 worth of crypto on Gemini’s mobile app or web platform.

Even when using Gemini’s ActiveTrader platform, maker fees are 0.25 percent, and taker fees are 0.35 percent for purchases below $500,000.

Plus, Binance offers an incredible incentive for BNB holders.

If you use Binance’s BNB tokens to trade, you’ll enjoy an incredible 25 percent discount.

Now that’s competitive pricing!

Of course, BNB isn’t as stable as fiat or stablecoins.

On the flipside, BNB is one of the top ten cryptocurrencies, so it’s probably not going away anytime soon.

Bottom line: If fees are a big deal for you, Binance is a far better platform to trade on.

Winner: Binance

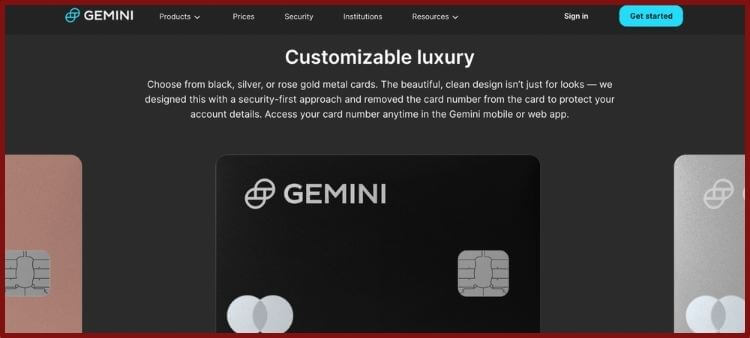

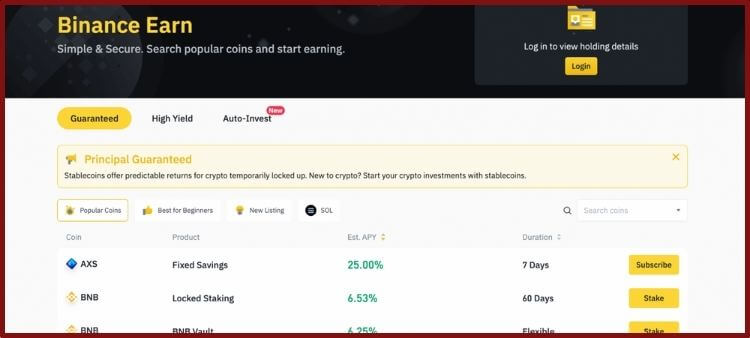

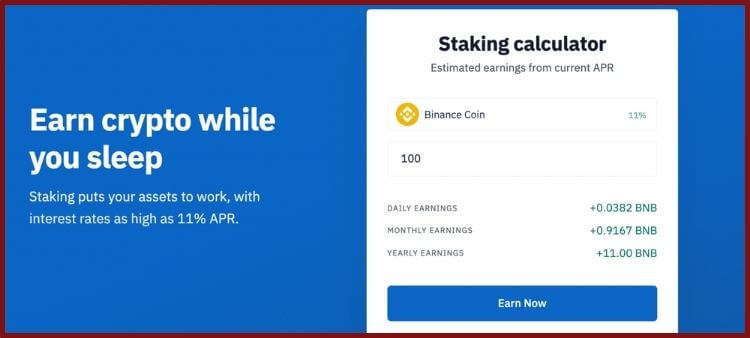

Passive Income

I never recommend keeping crypto on a centralized exchange.

No matter how big your exchange is, it’s always risky to entrust your private keys to another company.

However, I recognize that many exchanges offer convenient ways to earn passive income.

For instance, if you deposit a supported crypto into Gemini Earn, you could get up to 8 percent APY.

Generally, the highest return rates on Gemini Earn are for stablecoins such as UST or Gemini USD.

However, if you don’t feel like depositing into Gemini Earn, you should keep tabs on Gemini’s credit card.

This sleek new card will reward you with up to 3 percent back in BTC.

It’s also worth mentioning Gemini works with the NY-based crypto lending platform BlockFi.

BlockFi is well-known for its high interest rates, and it also has a cool crypto rewards credit card.

Although Binance also has an “Earn” feature, it’s limited in the USA.

Indeed, on Binance.us, you could only earn rewards on a few supported Proof of Stake coins.

Also, US citizens can’t get their hands on Binance’s crypto rewards credit card.

At least not yet.

On a positive note, US investors could earn passive income by staking coins on the non-custodial Trust Wallet app.

For those who don’t know, Binance owns Trust Wallet.

So, although there are ways to earn passive income on both platforms, it’s easier for US residents to work with Gemini.

Remember, there are risks to depositing crypto in staking pools or interest-bearing accounts.

Be sure you feel comfortable handing over your tokens before hitting “Confirm.”

Winner: Gemini

Pros & Cons Of Gemini vs. Binance

Gemini Pros

- Fully regulated in all US states.

- Exceptional security standards.

- FDIC insurance on USD.

- Clean and straightforward user interface.

- Generous “Earn” feature for passive income.

Gemini Cons

- High trading fees.

- Limited selection of altcoins like Dogecoin.

- Not as widely available outside the USA.

Binance Pros

- Largest crypto exchange on earth.

- Low trading fees.

- Easy integration with Trust Wallet and Binance Smart Chain.

- Wide selection of altcoins.

- SAFU Fund for crypto insurance.

Binance Cons

- Only available as Binance.us in the USA.

- User interface isn’t beginner-friendly.

- Faces more regulatory scrutiny in the US versus Gemini.

- Has suffered a major hack in the past.

Gemini vs. Binance — Is There A Clear Winner?

It’s hard to criticize Binance or Gemini.

However, for most Americans who are new to crypto, I’d recommend Gemini over Binance.us.

Why?

Well, Gemini is based in NYC, so it has a better reputation in North America.

Gemini’s simple user interface also takes all the complexity out of crypto investing.

Sure, the fees are higher on Gemini, but you could get decent discounts if you use the ActiveTrader platform.

Also, if you plan on making big purchases and “hodling” rather than trading, these fees aren’t such a huge deal.

For those interested in signing up for Gemini, please follow this link.

However, if you’re living outside the USA, Binance is probably the better option.

Binance’s user interface isn’t as clean as Gemini’s, but it has a more attractive fee structure for traders.

I’d only recommend Binance.us for crypto-savvy Americans who have a more aggressive trading strategy.

Please follow this link if you want a Binance account.

But before you sign up for one of these exchanges, you may want to check out my guide to “Coinbase vs. Gemini.”