Coinbase vs FTX – which exchange is better for crypto trading? This is a question that is on the mind of many crypto traders.

Both Coinbase and FTX are established exchanges that offer a range of trading services, but which one should you use for your crypto trading needs?

In this blog post, we’ll be looking at the pros and cons of Coinbase vs FTX to help you make an informed decision about which exchange is the better choice for your needs.

Overview of Coinbase and FTX exchanges

Coinbase and FTX are both prominent cryptocurrency exchanges that have gained popularity in the crypto trading world.

Coinbase, founded in 2012, is one of the oldest and most well-established exchanges in the industry. It has built a strong reputation for its user-friendly interface and robust security measures.

On the other hand, FTX is a relatively new exchange, launched in 2019, but it has quickly gained traction for its innovative trading features and extensive range of cryptocurrency offerings.

Both exchanges offer a variety of trading services, including spot trading, futures trading, and margin trading.

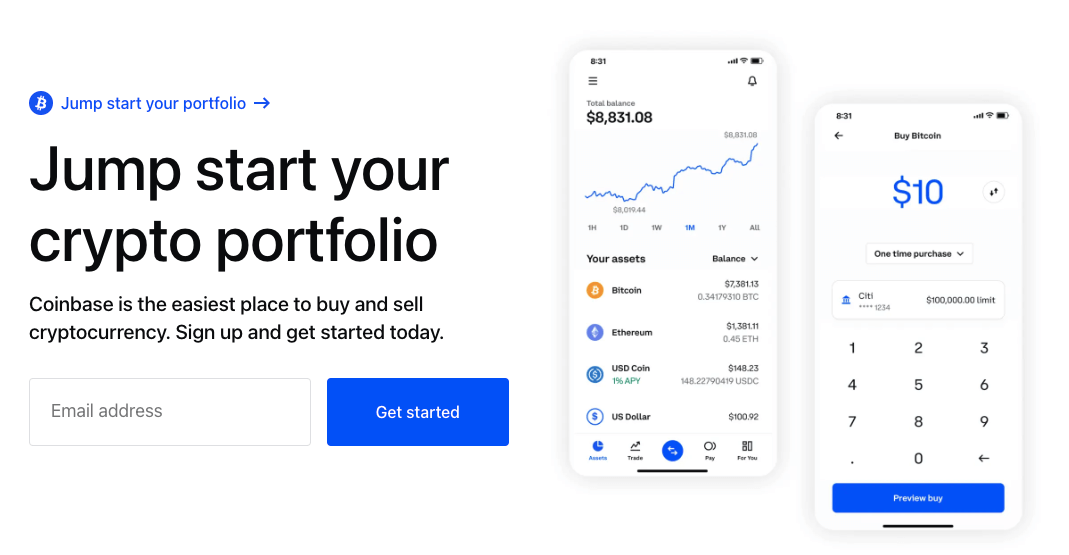

Coinbase primarily caters to retail investors, while FTX targets more experienced traders and institutions. Coinbase is known for its simplicity, making it an excellent choice for beginners who are just starting their crypto journey.

FTX, on the other hand, appeals to traders who want access to advanced trading tools and features like leverage trading and options contracts.

In terms of liquidity, Coinbase has a larger user base and trading volume, which can result in better liquidity for popular cryptocurrencies.

FTX, although growing rapidly, may have lower liquidity for some less popular coins. However, FTX does offer a wider selection of altcoins and innovative trading products, giving traders more options and opportunities to diversify their portfolios.

Both exchanges prioritize security and regulatory compliance. Coinbase is renowned for its stringent security measures, including two-factor authentication, cold storage for funds, and insurance coverage.

FTX also prioritizes security and has implemented features like withdrawal whitelisting and encryption protocols.

User experience comparison

When it comes to crypto trading, user experience is a crucial factor to consider. After all, you want a platform that is intuitive, user-friendly, and offers a smooth trading experience.

So, let’s compare the user experiences of Coinbase and FTX.

Coinbase is known for its simplicity and user-friendly interface. It’s designed with beginners in mind, making it easy to navigate and understand. Setting up an account and buying cryptocurrencies is straightforward, which is great for those who are new to the world of crypto trading. Coinbase also offers a mobile app, allowing you to trade on the go.

On the other hand, FTX is more suited for experienced traders who are comfortable with advanced trading features.

The platform offers a wide range of trading options, including leverage trading and options contracts. While this can be exciting for experienced traders, it may be overwhelming for beginners. FTX also offers a mobile app, making it convenient to trade wherever you are.

Both exchanges provide a seamless user experience overall, but it really comes down to your experience level and what you’re looking for in a trading platform.

If you’re a beginner, Coinbase’s user-friendly interface may be more suitable. However, if you’re an experienced trader looking for more advanced features, FTX could be the better option.

Trading fees comparison

Now let’s talk about everyone’s favorite topic: trading fees. When it comes to crypto trading, fees can have a significant impact on your overall profits and losses. So, it’s essential to understand the fee structures of both Coinbase and FTX.

Coinbase operates on a fee schedule that is based on your trading volume. The more you trade, the lower your fees will be.

However, it’s important to note that Coinbase charges higher fees compared to some other exchanges. The fees range from 0.5% to 4.5% per trade, depending on the transaction size and payment method.

FTX, on the other hand, has a slightly more complex fee structure. It offers tiered fees that depend on your 30-day trading volume.

The higher your trading volume, the lower your fees will be. FTX also has a fee rebate program, where market makers can receive rebates for adding liquidity to the platform.

In terms of trading fees, FTX generally has lower fees compared to Coinbase, especially for high-volume traders.

However, it’s important to consider other factors as well, such as the available features, user experience, and security measures, before making a decision solely based on fees.

Security and regulatory compliance

When it comes to trading cryptocurrencies, security and regulatory compliance are two vital factors that should never be overlooked.

Both Coinbase and FTX understand the importance of protecting their users’ assets and adhering to legal regulations in the industry.

Coinbase is well-known for its robust security measures. The platform implements two-factor authentication, which adds an extra layer of protection to your account.

Additionally, Coinbase stores the majority of its users’ funds in cold storage, meaning that they are kept offline and out of reach from hackers.

This provides an added level of security, as online wallets are more vulnerable to cyber attacks. Moreover, Coinbase is also insured, which means that if the platform experiences a security breach, your funds may be protected.

Similarly, FTX prioritizes security and takes steps to ensure the safety of its users’ assets. The exchange offers withdrawal whitelisting, which allows you to specify which addresses can receive your funds, minimizing the risk of unauthorized withdrawals.

Furthermore, FTX employs encryption protocols to protect your personal and financial information from being compromised.

In terms of regulatory compliance, both Coinbase and FTX operate in accordance with applicable laws and regulations.

Coinbase is licensed and regulated in multiple jurisdictions, including the United States, where it is registered with the Financial Crimes Enforcement Network (FinCEN) as a money services business.

FTX, on the other hand, operates under the supervision of regulatory authorities in various countries, including the United States and the United Kingdom.

Available cryptocurrencies

Now let’s dive into one of the most important factors when choosing a crypto exchange – the available cryptocurrencies.

Both Coinbase and FTX offer a wide range of digital assets for trading, but there are some differences to consider.

Coinbase has a more limited selection of cryptocurrencies compared to FTX. It focuses on the most popular and widely recognized coins, such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

This can be seen as an advantage for beginners who want to stick to well-established coins with a proven track record. Coinbase also has a strict listing process, which means that only a few new cryptocurrencies are added each year.

On the other hand, FTX offers a much broader selection of cryptocurrencies. It not only includes the major coins but also a variety of altcoins that may have higher growth potential.

FTX is known for being one of the first exchanges to list new and emerging coins, giving traders early access to potentially profitable investments. If you’re looking to explore new and lesser-known projects, FTX may be the better option for you.

Customer support and education

When it comes to trading cryptocurrencies, customer support and education are two crucial aspects that can greatly enhance your trading experience.

Both Coinbase and FTX recognize the importance of providing their users with excellent support and educational resources.

Coinbase offers a comprehensive customer support system, with a dedicated help center, FAQs, and a community forum where users can seek assistance and share their experiences.

They also provide email support for more personalized inquiries. In terms of education, Coinbase offers a vast library of educational content, including guides, tutorials, and videos to help users understand the basics of crypto trading and make informed decisions.

FTX also places a strong emphasis on customer support, with a dedicated support team that is available 24/7 to assist users. They offer live chat support for immediate assistance and have a comprehensive FAQ section that covers a wide range of topics.

FTX also provides educational resources, such as blog articles and video tutorials, to help users deepen their understanding of cryptocurrency trading strategies and market analysis.

Both exchanges strive to provide their users with the support and education they need to navigate the complex world of crypto trading.

However, it’s important to note that the quality and timeliness of customer support can vary depending on the volume of inquiries and the availability of support staff.

Overall, if customer support and education are important factors for you, it’s advisable to explore the resources offered by both Coinbase and FTX to determine which exchange provides the level of support and educational materials that align with your needs and preferences.

Pros and cons of each exchange

Now that we have explored the various aspects of Coinbase and FTX, let’s break down the pros and cons of each exchange. Keep in mind that these are general observations and your personal experience may vary.

Starting with Coinbase, one of the biggest advantages is its user-friendly interface. This makes it incredibly easy for beginners to navigate the platform and start trading.

Coinbase also has a strong reputation for security, with measures such as two-factor authentication and cold storage for funds. Another pro of Coinbase is its regulatory compliance, as it is licensed and regulated in multiple jurisdictions.

However, Coinbase does have some downsides. One of the main drawbacks is its limited selection of cryptocurrencies. While it covers the major coins, it may not have as many options for those looking to explore altcoins.

Additionally, Coinbase’s fees are higher compared to other exchanges, which can eat into your profits.

On the other hand, FTX offers a wider range of cryptocurrencies, including both established coins and emerging altcoins.

This gives traders more opportunities to diversify their portfolios and potentially find hidden gems. FTX also has lower fees, especially for high-volume traders, and offers advanced trading features like leverage trading and options contracts.

However, FTX may not be the best choice for beginners, as its interface and trading features can be overwhelming for those new to crypto trading. The exchange is more suited for experienced traders who are comfortable with advanced trading tools.

Final thoughts and recommendations.

After considering the various aspects of Coinbase and FTX, it’s time to make some final thoughts and recommendations.

Choosing the right exchange for your crypto trading needs can be a daunting task, but hopefully, this blog post has provided you with valuable information to make an informed decision.

If you’re a beginner looking for a user-friendly interface and a straightforward trading experience, Coinbase is a great option.

Its simplicity and security measures make it an excellent choice for those just starting their crypto journey. Plus, its regulatory compliance adds an extra layer of trust.

On the other hand, if you’re an experienced trader who wants access to a wider range of cryptocurrencies and advanced trading features, FTX is the way to go.

With its extensive selection of coins and innovative trading products, you’ll have more opportunities to diversify your portfolio and potentially find hidden gems.

Keep in mind that trading fees are an important consideration. Coinbase has slightly higher fees compared to FTX, especially for high-volume traders.

However, it’s crucial to weigh the fees against the other factors, such as available features, user experience, and security measures.

In the end, your choice between Coinbase and FTX depends on your individual trading goals, experience level, and preferences.

Take the time to research and compare the features and offerings of each exchange. It’s also a good idea to test out the platforms with small trades to see which one feels more intuitive and suits your trading style.

Remember, no exchange is perfect, and there will always be pros and cons. What’s important is finding the one that aligns with your needs and trading strategy.

So go ahead, explore both Coinbase and FTX, and start your crypto trading journey with confidence!