Love him or hate him, Brian Armstrong deserves props for creating Coinbase.

A few years after Bitcoin launched, Armstrong envisioned creating a safe, centralized crypto exchange.

Flash-forward a few years, and Coinbase is the top choice with American crypto investors.

Just how big is Coinbase?

Current estimates suggest 56 million people have an account on this platform.

Even more impressively, Coinbase is the first crypto exchange to list on the NYSE.

However, I understand not everyone is crazy about Coinbase.

Although I don’t have any complaints with Coinbase, some customers may not jive with this site.

For instance, a few critics don’t like that Coinbase got hacked in 2021. Others complain about its slow customer service.

Oh yeah, and don’t forget about those high trading fees!

Luckily for current crypto investors, there are plenty of alternatives to Coinbase.

If you’re not satisfied with Coinbase’s platform, you may want to read through this article.

Below, I’ll reveal a few of my favorite Coinbase alternatives.

To make your decision a little easier, I’ve sorted each of these exchanges with one stand-out feature.

As always, I promise to share super safe exchanges that I would feel comfortable using.

High-Quality Crypto Exchanges For Coinbase Haters — Five Fantastic Coinbase Alternatives

Best For Compliance & Security: Gemini

I’d argue that Gemini is the best alternative to Coinbase.

Why?

Well, Gemini and Coinbase are so dang similar!

First off, both of these exchanges are US-based.

Plus, since both companies are laser-focused on compliance, they’re available in all 50 states.

But the similarities don’t stop there!

Gemini and Coinbase have a user-friendly interface, spectacular cold storage security, and FDIC insurance for USD.

Unfortunately, Gemini also shares Coinbase’s higher-than-average trading fees.

However, you could cut down on your trading fees if you opt for Gemini’s “ActiveTrader” display.

Honestly, the only crucial difference between Gemini and Coinbase is that Coinbase has more altcoins.

Coinbase has about 100 tokens, while Gemini has around 50.

On the flip side, Gemini offers an “Earn” feature where you could earn interest by loaning your crypto to the company.

Plus, for any NFT fans out there, Gemini works with the trendy curated site Nifty Gateway.

So, if you’re looking for a centralized, US-based crypto exchange that’s easy for beginners, I doubt you’d be disappointed with Gemini.

If you’d like a more in-depth review of Gemini, I’d recommend reading my post on “Coinbase vs. Gemini.”

Best For Customer Service: Kraken

Like Gemini and Coinbase, Kraken is another highly-regarded American-based exchange.

In fact, since Kraken has been around since 2011, it’s arguably the “OG” US exchange.

However, unlike Gemini and Coinbase, Kraken isn’t available in all 50 states.

Currently, Washington State and New York residents can’t open an account on Kraken.

Still, Kraken is one of the most accessible exchanges in the USA.

So, why would someone want to use Kraken?

Well, as I hinted in the header, Kraken has superb customer service standards.

Unlike other crypto exchanges, Kraken boasts round-the-clock customer care via phone, chat, or email.

As you know from my post on “KuCoin vs. Binance,” quality customer care is rare in the crypto industry.

Having these support features on Kraken could make new investors feel more at ease.

Beyond Kraken’s customer service, this company has a great track record for security.

In fact, Kraken employs armed guards and 24/7 surveillance by all of their cold storage wallets.

While Kraken doesn’t offer as many altcoins as Coinbase, it has a little more than Gemini.

Please keep in mind that Kraken currently doesn’t offer ACH deposits for US customers.

If you’re concerned about customer service, Kraken may be the best Coinbase alternative.

For more details on Kraken’s features, please check out my review of “Gemini vs. Kraken.”

Best For Bonus Features: Crypto.com

Even if you’re not into crypto, it’s hard to miss Crypto.com’s logo.

This Singapore-based crypto exchange has been on a non-stop ad blitz for the past few years.

Whether it’s partnering with Matt Damon or taking over Staples Center, Crypto.com is arguably the most ambitious company in crypto.

However, that doesn’t mean Crypto.com is all hype and no substance.

For instance, Crypto.com partners with New York’s Metropolitan Commercial Bank and insures transferred funds up to $250,000.

Not only that, Crypto.com holds $750 million in crypto insurance, and it claims to store 100 percent of its digital assets on cold storage.

Just keep in mind that US residents can only use Crypto.com’s app at this time.

Although Crypto.com has an advanced desktop exchange, it’s currently unavailable in America.

If you don’t mind trading crypto on your cell phone, then the Crypto.com app has loads of features to take advantage of.

In fact, I’d argue Crypto.com is the most “feature-rich” experience in crypto.

Besides buying and selling tokens, you could stake coins for interest, apply for a Visa debit card, or interact with Crypto.com’s NFT Marketplace.

Crypto.com also has an EVM-compatible blockchain called Cronos.

Yeah, there’s a lot going on in Crypto.com’s ecosystem.

Just remember that Crypto.com is nowhere near as big as Coinbase or Binance. Plus, since Crypto.com is from Singapore, it can make customer service a hassle.

However, Crypto.com already has about 10 million loyal users, and the fan base seems to keep increasing.

If you don’t mind doing your crypto trading on your phone, I’d recommend checking out the opportunities Crypto.com has to offer.

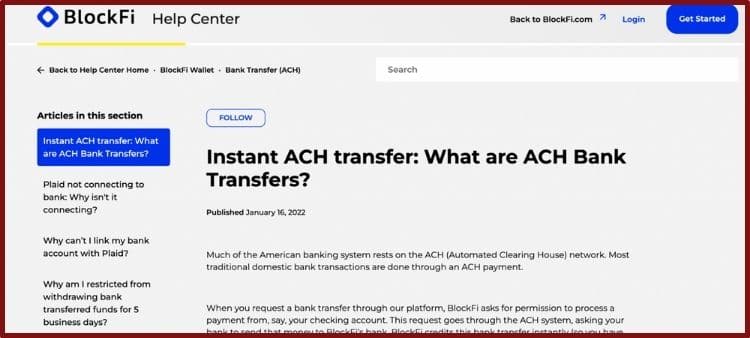

Best For Passive Income: BlockFi

I know, BlockFi isn’t technically a crypto exchange…but I think it’s close enough.

Based in New York, BlockFi is one of the top-tier crypto lending platforms.

However, this company recently allowed customers to send ACH transfers into their accounts.

So, you could buy crypto directly with a BlockFi account.

Admittedly, altcoin fans won’t enjoy the limited selection on BlockFi.

However, people who want passive income will love the interest-bearing accounts BlockFi offers.

After you buy crypto on BlockFi, you could immediately put it into interest-yielding accounts for a steady stream of passive income.

Not only that, BlockFi was the first company to offer a crypto rewards credit card.

Everyone who uses this credit card earns rewards paid in any crypto supported on BlockFi.

So, if you’re most interested in making your crypto grow, I’d suggest building a BlockFi portfolio.

True, BlockFi doesn’t have the best selection of altcoins, but it has many ways for customers to earn yield.

You can click this link to download your BlockFi account.

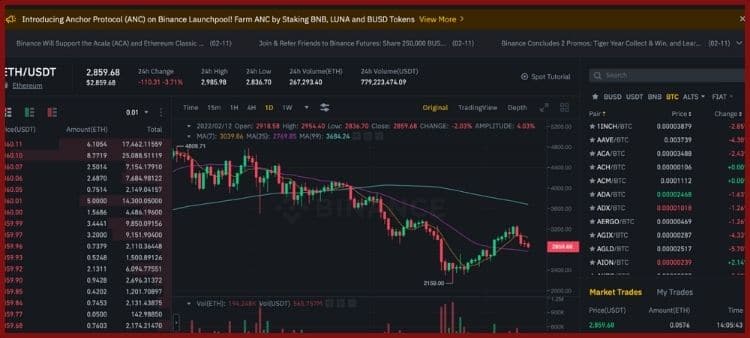

Best For Low Trading Fees: Binance.us

In America, Coinbase is the “crypto kahuna.”

However, if you look at global crypto trading volumes, Binance is the king of crypto.

There are many explanations for Binance’s spectacular growth, but one big reason has to do with its competitive trading fees.

When you use Binance, you’ll only have to pay a flat fee of 0.1 percent on all transactions.

But wait, there’s more!

If you use Binance’s BNB token while trading, you’ll get an additional 25 percent off.

The only issue is that US residents still can’t sign up for a “true” Binance account.

Instead, you’ll have to feel comfortable using the subsidiary Binance.us.

While Binance.us has the same impressive fee structure, it doesn’t have the same number of altcoins as on Binance.

Instead of roughly 400 coins, Binance.us has about 100 total tokens.

Still, there’s a lot to love on Binance.us if you’re an active trader.

Note: Binance’s interface isn’t as user-friendly as the other options on this list.

Total beginners may have issues figuring out how to interact with Binance.us’s advanced platform.

However, if you’re looking for the best deal on your crypto trades, Binance.us has undeniably attractive rates.

Is PayPal A Good Alternative To Coinbase?

As you might’ve already heard, PayPal has been getting pretty serious about satoshis.

PayPal recently partnered with Paxos to offer its customers access to the following cryptocurrencies:

- Bitcoin

- Litecoin

- Ethereum

- Bitcoin Cash

While this may seem like an excellent choice for beginners, there are drawbacks to using PayPal or Venmo for crypto.

First off, you can’t take your crypto off of PayPal.

All you could do is buy, sell, and hold your crypto on your PayPal account.

So, if you wanted to use Ethereum on DeFi, PayPal isn’t the place for you.

Also, PayPal has some pretty steep trading fees.

Even if you spent over $1,000.01 on crypto, you’d have to pay a 1.5 percent fee.

Below that, you’ll have to pay between 2.3 – 1.8 percent when buying and selling crypto.

If you’re serious about holding crypto for the long term, I’d strongly recommend using a centralized exchange like Coinbase so you can send your tokens to a private wallet.

However, if you don’t care about self-custodying your crypto, sending crypto to a friend, or using Web3 dApps, buying on PayPal may be an easy way to trade big-cap coins.

Just remember you don’t hold the private keys to crypto on PayPal.

You have to trust PayPal and Paxos are making good on their promises.

FYI: If you’re still dead-set on using PayPal to buy crypto, you could integrate it with a Coinbase account.

Just keep in mind that Coinbase charges extra for this feature.

Alternatives To Coinbase — Which Exchange Fits Your Trading Goals?

If you’ve read through my previous posts, you know I’m a fan of Coinbase.

Personally, I haven’t had any significant issues buying and transferring crypto through this exchange.

I also love that Coinbase has a long track record for safety, compliance, and customer insurance.

Plus, it’s fun to earn a few altcoins by watching videos on Coinbase’s “Earn To Learn” page!

However, I know there are many great alternatives to Coinbase in today’s crypto market.

Since choosing a crypto exchange is a personal preference, I can’t say what would be best for you.

However, it’s easier to pick a crypto exchange if you know your crypto strategy beforehand.

For instance, an active altcoin trader will most appreciate Binance.us’s low fees.

However, total crypto beginners may prefer Gemini’s ease of use and compliance standards.

Please write down what you want in an exchange and review each of the options listed above.

After some research, you should know which company is the right fit for you.

Want to learn how I make money using crypto? Check out my favorite node project here.