Are you considering signing up for Robinhood Gold, the company’s premium subscription service?

Before you make your decision, it’s important to understand what Robinhood Gold is and how it works.

In this Robinhood Gold review, we’ll look at the features and benefits of the service, as well as some potential drawbacks to consider before signing up.

By the end of this Robinhood Gold review, you’ll have a better understanding of whether or not it’s the right choice for you.

What is Robinhood Gold?

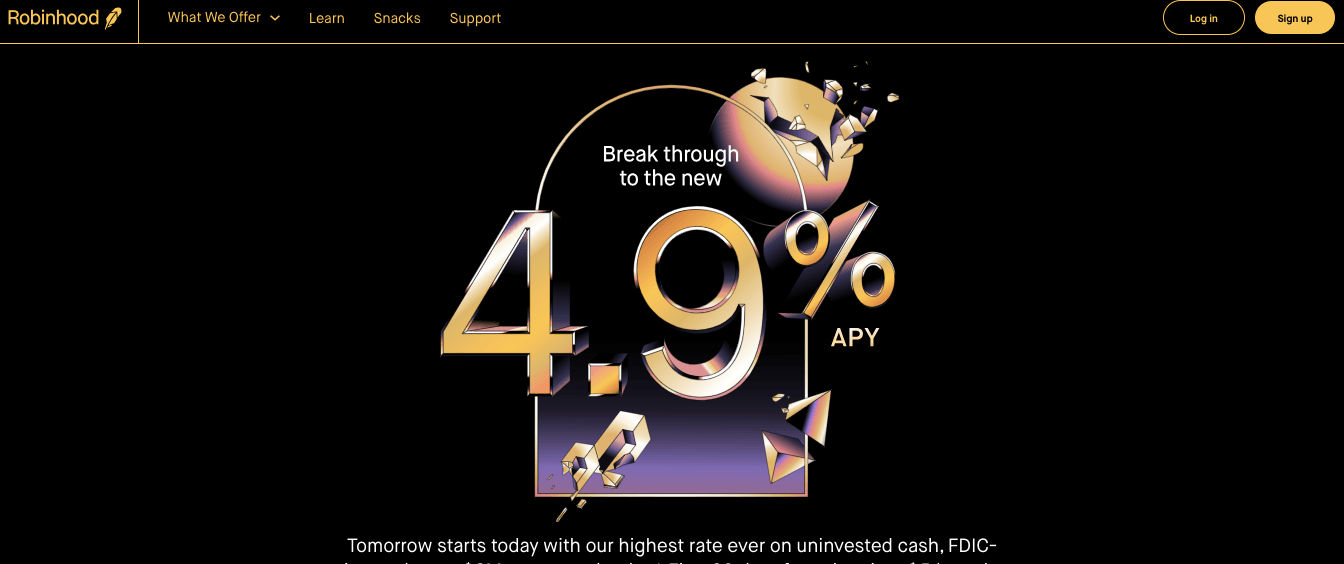

Robinhood Gold is a premium subscription service offered by the popular investment app, Robinhood. It is designed to provide additional features and benefits to enhance your investing experience. So, what exactly does Robinhood Gold offer?

First and foremost, Robinhood Gold gives you access to extended trading hours. This means you can buy and sell stocks before the market opens and after it closes. This can be a game-changer if you want to take advantage of early morning news or react to after-hours earnings releases.

Another key feature of Robinhood Gold is the ability to trade on margin. This essentially means that you can borrow money from Robinhood to invest, allowing you to potentially increase your buying power and potential returns. However, it’s important to remember that trading on margin also comes with added risk, as losses can be magnified.

In addition to these features, Robinhood Gold also provides access to in-depth market data, including real-time quotes and Level II market data. This can help you make more informed investment decisions by providing a deeper understanding of the market dynamics.

Overall, Robinhood Gold offers a range of features and benefits that can enhance your investing experience.

However, it’s important to carefully consider whether the cost and added risks are worth it for your individual investment goals and risk tolerance. In the next section, we’ll take a closer look at the costs associated with Robinhood Gold.

Features and Benefits of Robinhood Gold

Now that we’ve covered what Robinhood Gold is, let’s dive into its features and benefits. One of the main advantages of Robinhood Gold is the access to extended trading hours.

This means you can make trades before the market opens and after it closes, giving you a leg up on the competition. Whether you want to react to early morning news or make moves based on after-hours earnings releases, this feature can be a game-changer.

Another great feature of Robinhood Gold is the ability to trade on margin. This means you can borrow money from Robinhood to invest, potentially increasing your buying power and potential returns. However, it’s crucial to keep in mind that trading on margin also comes with added risk, as losses can be magnified.

Lastly, Robinhood Gold provides in-depth market data, including real-time quotes and Level II market data. This valuable information can help you make more informed investment decisions by giving you a deeper understanding of the market dynamics.

Overall, Robinhood Gold offers some fantastic features and benefits that can enhance your investing experience. However, it’s essential to carefully weigh the costs and added risks against your individual investment goals and risk tolerance.

How much does Robinhood Gold Cost?

One of the most important factors to consider when deciding whether or not to sign up for Robinhood Gold is the cost. After all, you want to make sure you’re getting value for your money. So, how much does Robinhood Gold actually cost?

Robinhood Gold offers two different pricing tiers: $5 per month and $10 per month. The $5 per month tier gives you access to features like extended trading hours, the ability to trade on margin, and in-depth market data. If you’re looking for even more features and benefits, the $10 per month tier offers everything included in the $5 tier, plus additional buying power and access to larger instant deposits.

While the cost of Robinhood Gold may seem reasonable, it’s important to carefully consider whether or not it’s worth it for your individual investment goals and risk tolerance. Take into account how often you plan to use the extended trading hours and the potential risks associated with trading on margin.

Ultimately, the decision of whether or not to sign up for Robinhood Gold comes down to your personal preferences and financial situation. It’s important to weigh the cost against the potential benefits and determine if it aligns with your investment strategy.

Is Robinhood Gold Worth It?

So, now that we’ve gone over all the features, benefits, and costs of Robinhood Gold, the big question is: Is it worth it? Well, the answer really depends on your individual investment goals and risk tolerance.

If you’re someone who loves to be on top of the market and wants the ability to trade before and after regular market hours, then Robinhood Gold’s extended trading hours feature could be a game-changer for you. It gives you the opportunity to react quickly to breaking news and potentially make moves before other investors have a chance to.

On the other hand, if you’re not someone who actively trades and prefers to take a more long-term, hands-off approach to investing, then the additional cost of Robinhood Gold may not be worth it for you. It’s important to consider how often you’ll actually utilize the features and benefits of the service.

Additionally, the ability to trade on margin can be both a blessing and a curse. While it can potentially increase your buying power and returns, it also comes with added risk. Losses can be magnified, and if you’re not careful, it can lead to significant losses.

Ultimately, whether or not Robinhood Gold is worth it comes down to your personal preferences and financial situation. Take the time to carefully weigh the potential benefits against the costs and risks, and determine if it aligns with your investment strategy.

Risks and Considerations of Robinhood Gold

Now, let’s talk about the risks and considerations of using Robinhood Gold. While the premium subscription offers some fantastic features and benefits, it’s important to be aware of the potential downsides.

Firstly, trading on margin can be risky. While it may provide you with increased buying power and potential for higher returns, it also amplifies the risk of losses. If the market goes against you, your losses could be greater than the initial investment.

Secondly, the extended trading hours can be enticing, but they also come with their own risks. The increased volatility during these times can lead to rapid price changes, making it more challenging to execute trades at the desired price. It requires careful monitoring and quick decision-making, which may not be suitable for everyone.

Additionally, the monthly cost of Robinhood Gold should be considered. While $5 or $10 per month may seem reasonable, it’s essential to evaluate whether the additional features are worth the expense, especially if you’re not planning to utilize them frequently.

Lastly, it’s crucial to assess your own risk tolerance and investment strategy. Robinhood Gold may not be suitable for conservative investors or those who prefer a more long-term, hands-off approach.

It’s essential to carefully weigh these risks and considerations against the potential benefits before deciding if Robinhood Gold is the right choice for you.

Customer Reviews and Ratings of Robinhood Gold

So, you’ve heard about Robinhood Gold and you’re curious to know what other people think about it. Well, let’s dive into some customer reviews and ratings to get a better understanding.

Overall, the reviews for Robinhood Gold are quite positive. Many users appreciate the extended trading hours and the ability to trade on margin. They find it convenient and exciting to have the opportunity to make trades before and after regular market hours. Some users have even reported making significant profits thanks to these extended trading hours.

However, it’s not all sunshine and rainbows. There are some users who have experienced difficulties with executing trades during the extended trading hours. They’ve mentioned that the increased volatility can make it challenging to get the desired price for their trades. Additionally, a few users have also expressed concerns about the risks associated with trading on margin.

It’s important to remember that these reviews are subjective and based on individual experiences. What works for one person may not work for another. It’s always a good idea to carefully consider your own investment goals and risk tolerance before making a decision.

Overall, Robinhood Gold seems to have satisfied many users and enhanced their investing experience. It’s worth considering if you’re someone who actively trades and wants the added benefits that come with the subscription. Just be sure to weigh the pros and cons before diving in.